By FXEmpire.com

AUD/USD Fundamental Analysis April 11, 2012 Forecast

Analysis and Recommendation: (close of Asian session)

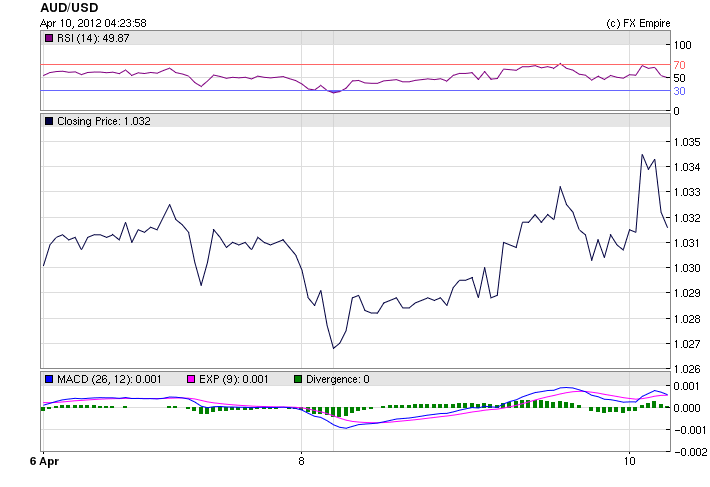

The AUD/USD was trading at 103.40 US cents, up from 103.05 cents on Thursday, before the Easter public holiday.

The Australian dollar has moved higher, as US markets weakened in response to unimpressive jobs figures.

US non-farm payrolls data, released on Good Friday, showed that 120,000 jobs were created in March, well below the market expectation of 203,000 jobs.

The US stock market and currency dropped following the data’s release.

This is because with the labor market looking weaker, it looks like QE3 (quantative easing) is not completely off the table, at least for traders.

Chinese CPI rose 3.6 per cent in March from a year earlier, compared to a rise of 3.2 per cent in February.

Chinese balance of trade figures are expected on Tuesday, and gross domestic product data is due on Friday.

Economic Data for April 9-10, 2012 actual v. forecast

|

Apr. 09 |

JPY |

Adjusted Current Account |

0.85T |

0.66T |

0.14T |

|

CNY |

Chinese CPI (YoY) |

3.6% |

3.3% |

3.2% |

|

|

CNY |

Chinese PPI (YoY) |

-0.3% |

-0.2% |

0.0% |

|

|

JPY |

Economy Watchers Current Index |

51.8 |

46.5 |

45.9 |

|

|

RUB |

Russian Interest Rate Decision |

8.00% |

8.00% |

8.00% |

|

|

TRY |

Turkish Industrial Production (YoY) |

4.40% |

3.50% |

1.50% |

|

|

TWD |

Taiwanese Trade Balance |

2.36B |

2.19B |

2.83B |

|

|

EUR |

Greek CPI (YoY) |

1.70% |

2.10% |

||

|

EUR |

Greek Industrial Production (YoY) |

-8.30% |

-5.00% |

||

|

EUR |

Portuguese Trade Balance |

-2.88B |

-3.08B |

||

|

USD |

CB Employment Trends Index |

107.28 |

107.47 |

||

|

USD |

3-Month Bill Auction |

0.085% |

0.075% |

||

|

USD |

6-Month Bill Auction |

0.150% |

0.140% |

||

|

Apr. 10 |

GBP |

RICS House Price Balance |

-10% |

-12% |

-13% |

|

USD |

Fed Chairman Bernanke Speaks |

||||

|

AUD |

AIG Construction Index |

36.2 |

35.6 |

||

|

AUD |

NAB Business Confidence |

3 |

1 |

||

|

MYR |

Malaysian Trade Balance |

10.58B |

9.20B |

8.75B |

|

|

MYR |

Malaysian Industrial Production (YoY) |

7.5% |

6.5% |

0.3% |

Economic Events for April, 11, 2012

02:30 AUD Home Loans (MoM) -3.5% -1.2%

Home Loans record the change in the number of new loans granted for owner-occupied homes. It is a leading indicator of demand in the housing market.

13:30 USD Import Price Index (MoM) 0.8% 0.4%

The Import Price Index measures the change in the price of imported goods and services purchased domestically.

19:00 USD Federal Budget Balance -201.5B -232.0B

The Federal Budget Balance measures the difference in value between the federal government’s income and expenditure during the reported month. A positive number indicates a budget surplus; a negative number indicates a deficit.

Government Bond Auctions April 10-20, 2012

Apr 11 09:10 Italy BOT auction

Apr 11 09:30 Germany Eur 5.0bn new Jul 2022 Bund

Apr 11 09:10 Sweden Sek 5.0bn Jul 2012 & Sek 5.0bn Sep 2012 T-bills

Apr 11 09:30 Swiss Bond auction

Apr 11 09:30 UK Gbp 4.5bn 1.0% Sep 2017 Conventional Gilt

Apr 11 10:00 Norway Details T-bill auction on Apr 16

Apr 11 14:30 Sweden Details nominal bond auction on Apr 18

Apr 11 17:00 US Auctions 10Y Notes

Apr 12 09:10 Italy BTP/CCTeu auction

Apr 12 09:30 UK Gbp 2.0bn 4.25% Jun 2032 Conventional Gilt

Apr 12 15:00 US Announces auction of 5Y TIPS on Apr 19

Apr 12 17:00 US Auctions 30Y Bonds

Apr 13 10:00 Belgium OLO mini bond auction

Apr 16-30 n/a UK Re-opened 3.75% 2052 Conventional Gilt syndication

Apr 16 09:10 Slovakia Auctions floating rate Nov 2016 & 4.35% Oct 2025 & Bonds

Apr 16 09:10 Norway T-bill auction

Apr 17 08:30 Spain 12 & 18M T-bill auction

Apr 17 09:30 Belgium Auctions 3 & 12M T-bills

Apr 18 09:10 Sweden Nominal bond auction

Apr 18 09:30 Germany Eur 5.0bn 0.25% Mar 2014 Schatz

Apr 18 14:30 Sweden Details T-bill auction on Apr 25

Apr 19 08:30 Spain Obligacion auction

Apr 19 08:50 France BTAN auction

Apr 19 09:30 UK Auctions 0.125% I/L Gilt 2029

Apr 19 09:50 France OATi auction

Apr 19 15:00 US Announces 2Y Notes on Apr 24, 5Y Notes on Apr 25 & 7Y Notes on Apr 26

Apr 19 17:00 US Auctions 5Y TIPS

Apr 20 15:30 Italy Details CTZ/BTPei on Apr 24 & BOT on Apr 26

Originally posted here