By FX Empire.com

AUD/USD Fundamental Analysis March 13, 2012 Forecast

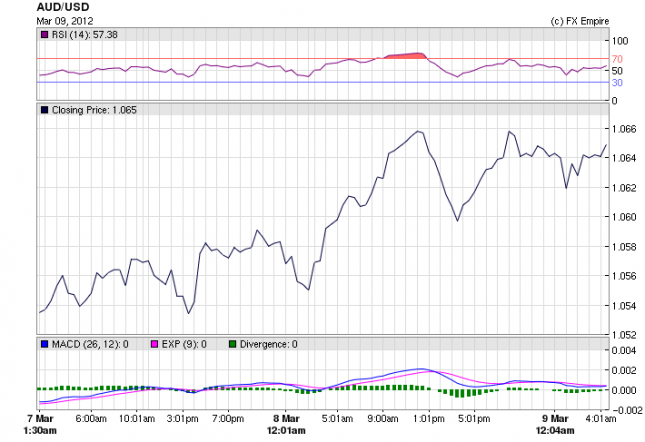

Analysis and Recommendation: (close of Asian session)

AUD/USD is trading at 1.0525, The Australian dollar is more than one US cent lower as markets react to weak trade figures from China.

The currency began falling over the weekend after strong American jobs data lifted the US dollar at the expense of its Australian counterpart, and as more negative data was released in China.

Last week China released several economic reports, all having negative sentiments or lacking strong support. These included,

China’s consumer price index rose at a weaker-than-expected rate of 3.2% in February from the same month a year earlier. The producer price index for February came in at 0%, also weaker than expected and slowing from January’s 0.7% year-on-year increase. Also China’s industrial production and retail sales growth weakened in the first two months of 2012 from the year-earlier period, an official data release showed Friday. Industrial production for the January to February period climbed 11.4%, falling short of a 12.4% increase anticipated.

This data culminated over the weekend when China posted a trade deficit of $31.48 billion in February after reporting a $27.28 billion surplus in January, according to data released by the General Administration of Customs on Saturday.

Economic Releases actual v. forecast

|

Mar. 12 |

00:50 |

JPY |

CGPI (YoY) |

0.6% |

0.6% |

0.5% |

||

|

00:50 |

JPY |

Core Machinery Orders (MoM) |

3.4% |

2.3% |

-7.1% |

|||

|

06:00 |

JPY |

Household Confidence |

39.5 |

40.6 |

40.0 |

|||

Scheduled Economic Events for March 13, 2012

Asia

00:50 JPY Tertiary Industry Activity Index (MoM) 0.4% 1.4%

The Tertiary Industry Index measures the change in the total value of services purchased by businesses. It is a leading indicator of economic health.

01:30 AUD Home Loans (MoM) -0.1% 2.3%

Home Loans record the change in the number of new loans granted for owner-occupied homes. It is a leading indicator of demand in the housing market.

01:30 AUD NAB Business Confidence 4

The National Australia Bank (NAB) Business Confidence Index rates the current level of business conditions in Australia. Changes in business sentiment can be an early signal of future economic activity such as spending, hiring, and investment. The index is based on data collected from a survey of around 350 companies. A level above zero indicates improving conditions; below indicates worsening conditions.

Tent JPY Interest Rate Decision 0.10% 0.10%

Tent JPY BoJ Press Conference

Bank of Japan (BOJ) policy board members come to a consensus on where to set the rate. Traders watch interest rate changes closely as short term interest rates are the primary factor in currency valuation.

The Bank of Japan (BOJ) press conference looks at the factors that affected the most recent interest rate decision, the overall economic outlook, inflation and offers insights into future monetary policy decisions.

US

13:30 USD Core Retail Sales (MoM) 0.8% 0.7%

13:30 USD Retail Sales (MoM) 1.0% 0.4%

(Core and ) Retail Sales measures the change in the total value of sales at the retail level in the U.S., excluding automobiles. It is an important indicator of consumer spending and is also considered as a pace indicator for the U.S. economy.

19:15 USD Interest Rate Decision 0.25% 0.25%

19:15 USD FOMC Statement

Federal Open Market Committee (FOMC) members vote on where to set the rate. Traders watch interest rate changes closely as short term interest rates are the primary factor in currency valuation. Along with the Decision the U.S. Federal Reserve’s Federal Open Market Committee (FOMC) statement is the primary tool the panel uses to communicate with investors about monetary policy. It contains the outcome of the vote on interest rates, discusses the economic outlook and offers clues on the outcome of future votes.

Government Bond Auction Schedule (this week)

Mar 13 09:30 Netherlands Eur 2.5bn-3.5bn re-opened Apr 2015 DSL

Mar 13 10:10 Italy BOT auction

Mar 13 10:30 Belgium Auctions 3 & 12M T-bills

Mar 13 15:30 UK Details gilt auction on Mar 22

Mar 13 18:00 US Auctions 10Y Notes

Mar 14 10:10 Italy BTP/CCTeu auction

Mar 14 10:10 Sweden Auctions T-bills

Mar 14 10:30 Swiss Bond auction

Mar 14 15:30 Sweden Details nominal bond exchange auction on Mar 21

Mar 14 18:00 US Auctions 30Y Bonds

Mar 15 09:30 Spain Obligacion auction

Mar 15 09:50 France BTAN auction

Mar 15 10.30 UK Auctions 4.5% 2042 conventional Gilt

Mar 15 10:50 France OATi auction

Mar 15 16:00 US Announces auction of 10Y TIPS on Mar 22

Originally posted here