By FX Empire.com

AUD/USD Fundamental Analysis March 15, 2012 Forecast

Analysis and Recommendation: (close of Asian session)

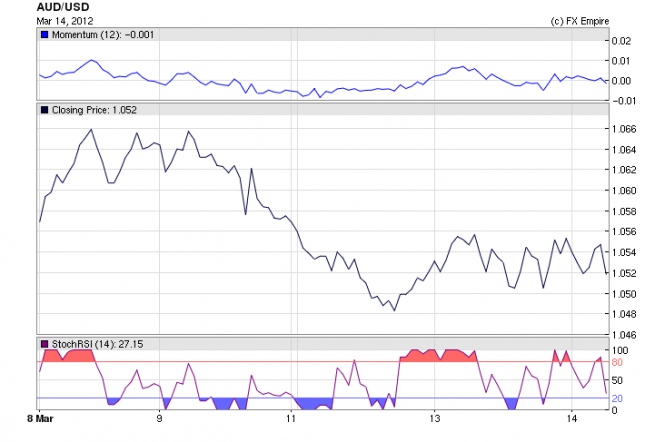

AUD/USD ended the Asian session at 1.0514, down from 1.0552. The Aussie dipped against a stronger US dollar but regained in early morning after US stock markets rallied and the ASX200 opened higher.

The Aussie then fell after the release of weaker domestic economic data.

Westpac Consumer Sentiment Index indicated consumer confidence fell following the Reserve Bank of Australia’s decisions in February and March to keep the official interest rate on hold. Most investors were expecting a rate decrease in February. Home Buyers and businesses were disappointed.

Meanwhile, home building data released by the Australian Bureau of Statistics showed work on new homes continued to fall, after banks began raising rates.

“Overseas economies still have not emerged from a deceleration phase on the whole but some improvement has recently been observed in the U.S. economy and the sluggish European economy has stopped deteriorating,” the central bank said. The BoJ kept key rates and also announced it would increase the amount of loans available through its growth supporting facility by 2 trillion yen ($24.35 billion)

Japanese exporters are once again making ground as the dollar bought increased to 83.17 yen, Japanese exported need the dollar to remain at 82.00 to be profitable.

US Retail sales climbed to a five-month high in February, as rising gasoline prices weren’t enough to choke off demand for cars, clothing and other goods. The Commerce Department said Tuesday that retail sales rose a seasonally adjusted 1.1%

The FOMC members held their course today, taking no new actions and offering few hints about their eagerness to start on future programs to strengthen the recovery. In their appraisal of the U.S. Economy, the central bank officers recognized increase in the employment market, but warned that business hazards remain and that inflation could rise briefly due to the current increase in gas and oil costs. All but one member voted to keep the central bank’s easy-money policies in place after a one-day meeting of the Fed. Open Market Council, the Federal Reserve’s policy-making body. The Federal Reserve repeated its goal to keep short term interest at “low levels” thru late 2014.

March 13 after Asian Session and March 14, 2012 Asian Events actual v. forecast

|

Mar. 13 |

GBP |

Trade Balance |

-7.5B |

-7.8B |

-7.2B |

|

EUR |

German ZEW Economic Sentiment |

22.3 |

10.5 |

5.4 |

|

|

EUR |

ZEW Economic Sentiment |

11.0 |

3.8 |

-8.1 |

|

|

USD |

Core Retail Sales (MoM) |

0.9% |

0.8% |

1.1% |

|

|

USD |

Retail Sales (MoM) |

1.1% |

1.1% |

0.6% |

|

|

USD |

10-Year Note Auction |

2.076% |

2.020% |

||

|

USD |

Interest Rate Decision |

0.25% |

0.25% |

0.25% |

|

|

Mar. 14 |

KRW |

South Korean Unemployment Rate |

3.7% |

3.5% |

3.2% |

|

AUD |

Westpac Consumer Sentiment |

-5.00% |

4.20% |

||

|

JPY |

BSI Large Manufacturing Conditions |

-7.3 |

1.3 |

-6.1 |

|

|

JPY |

Industrial Production (MoM) |

1.9% |

2.1% |

2.0% |

There are no significant economic events scheduled in Australia, New Zealand or Japan today.

13:30 USD Core PPI (MoM) 0.2% 0.4%

13:30 USD PPI (MoM) 0.5% 0.1%

The Core Producer Price Index (PPI) measures the change in the selling price of goods and services sold by producers, excluding food and energy. The PPI measures price change from the perspective of the seller. When producers pay more for goods and services, they are more likely to pass the higher costs to the consumer, so PPI is thought to be a leading indicator of consumer inflation.

13:30 USD Initial Jobless Claims 356K 362K

13:30 USD Continuing Jobless Claims 3416K

Initial Jobless Claims measures the number of individuals who filed for unemployment insurance for the first time during the past week. This is the earliest U.S. economic data, but the market impact varies from week to week. Continuing Jobless Claims measures the number of unemployed individuals who qualify for benefits under unemployment insurance.

13:30 USD NY Empire State Manufacturing Index 17.4 19.5

The Empire State Manufacturing Index rates the relative level of general business conditions New York state. A level above 0.0 indicates improving conditions, below indicates worsening conditions. The reading is compiled from a survey of about 200 manufacturers in New York State.

14:00 USD TIC Net Long-Term Transactions 29.3B 17.9B

Treasury International Capital (TIC) Net Long-Term Transactions measures the difference in value between foreign long-term securities purchased by U.S. citizens and U.S. long-term securities purchased by foreign investors. Demand for domestic securities and currency demand are directly linked because foreigners must buy the domestic currency to purchase the nation’s securities.

15:00 USD Philadelphia Fed Manufacturing Index 11.4 10.2

The Philadelphia Federal Reserve Manufacturing Index rates the relative level of general business conditions in Philadelphia. A level above zero on the index indicates improving conditions; below indicates worsening conditions. The data is compiled from a survey of about 250 manufacturers in the Philadelphia Federal Reserve district.

Government Bond Auction Schedule (this week)

Mar 15 09:30 Spain Obligacion auction

Mar 15 09:50 France BTAN auction

Mar 15 10.30 UK Auctions 4.5% 2042 conventional Gilt

Mar 15 10:50 France OATi auction

Mar 15 16:00 US Announces auction of 10Y TIPS on Mar 22

Originally posted here