By FX Empire.com

AUD/USD Fundamental Analysis March 16, 2012 Forecast

Analysis and Recommendation: (close of Asian session)

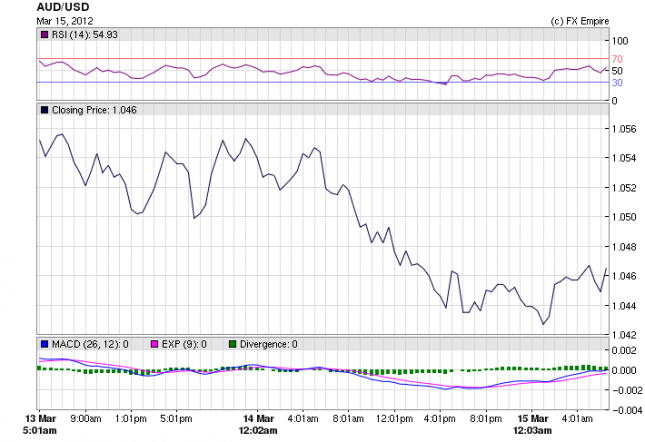

AUD/USD 1.0480 having moved up from the bottom of 1.0431

A stronger US currency and local data showing a fall in housing starts and consumer confidence weighed on market sentiment.

The Australian dollar was trading at 1.0423 US cents in mid day trading. The pair have traded 104.14 US cents, until late in the trading session as the USD lost its oomph the Aussie was able to recover, and bounced back to end the day up.

The aussie first dipped on Wednesday following the release of weaker domestic data.

Westpac Consumer Sentiment Index fell by 5.0 per cent to 96.1 index points in March, and housing started posted a third consecutive quarterly fall.

The Australian dollar had been quite resilient in the face of negative trade data from China over the weekend showing that nation’s first trade deficit in more than a year. There was a reaction following the Chinese data but it’s since recovered.

This was followed by comments overnight by US Federal Reserve chairman Ben Bernanke that economic conditions would improve in the US, although rising oil prices would push up inflation.

Released Economic Reports for March 14, 2012 actual v. forecast

|

Date |

Currency |

Event |

Actual |

Forecast |

Previous |

|

Mar. 14 |

KRW |

South Korean Unemployment Rate |

3.7% |

3.5% |

3.2% |

|

AUD |

Westpac Consumer Sentiment |

-5.00% |

4.20% |

||

|

JPY |

BSI Large Manufacturing Conditions |

-7.3 |

1.3 |

-6.1 |

|

|

JPY |

Industrial Production (MoM) |

1.9% |

2.1% |

2.0% |

|

|

JPY |

BoJ Monthly Report | ||||

|

GBP |

Average Earnings Index +Bonus |

1.4% |

1.9% |

1.9% |

|

|

GBP |

Claimant Count Change |

7.2K |

6.0K |

7.0K |

|

|

EUR |

CPI (YoY) |

2.7% |

2.7% |

2.7% |

|

|

EUR |

Industrial Production (MoM) |

0.2% |

0.7% |

-1.1% |

|

|

EUR |

Core CPI (YoY) |

1.5% |

1.6% |

1.5% |

|

|

USD |

Current Account |

-124.1B |

-114.0B |

-108.0B |

|

|

USD |

Import Price Index (MoM) |

0.4% |

0.6% |

0.0% |

Economic Events for March 16, 2012

Time Currency Event Forecast Previous

00:50 JPY Monetary Policy Meeting Minutes

The Monetary Policy Meeting Minutes are a detailed record of the Bank of Japan’s policy setting meeting, containing in-depth insights into the economic conditions that influenced the decision on where to set interest rates.

13:30 USD Core CPI (MoM) 0.2% 0.2%

13:30 USD CPI (MoM) 0.4% 0.2%

The Consumer Price Index (CPI) measures the change in the price of goods and services from the perspective of the consumer. It is a key way to measure changes in purchasing trends and inflation.

14:15 USD Industrial Production (MoM) 0.4% 0.0%

Industrial Production measures the change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities.

14:55 USD Michigan Consumer Sentiment Index 75.7 75.3

The University of Michigan Consumer Sentiment Index rates the relative level of current and future economic conditions. There are two versions of this data released two weeks apart, preliminary and revised. The preliminary data tends to have a greater impact. The reading is compiled from a survey of around 500 consumers.

Government Bond Auction Schedule (this week)

Mar 15 09:30 Spain Obligacion auction

Mar 15 09:50 France BTAN auction

Mar 15 10.30 UK Auctions 4.5% 2042 conventional Gilt

Mar 15 10:50 France OATi auction

Mar 15 16:00 US Announces auction of 10Y TIPS on Mar 22

Originally posted here