By FXEmpire.com

AUD/USD Fundamental Analysis March 21, 2012 Forecast

Analysis and Recommendation: (close of Asian session)

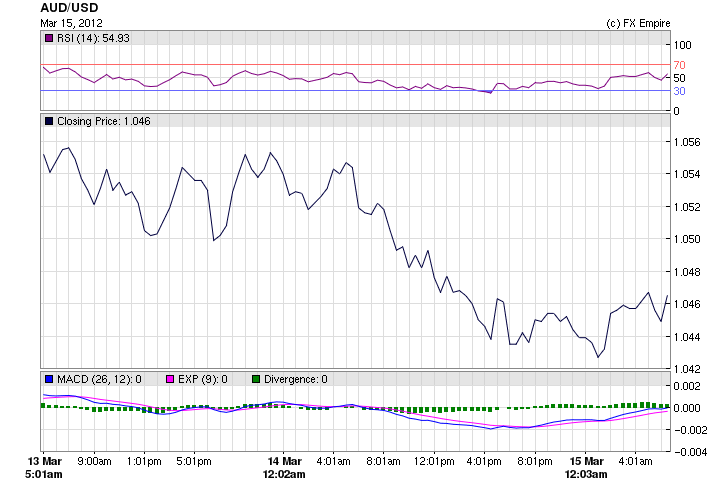

AUD/USD is trading at 1.0580

At midday, the Australian dollar was trading at 106.18 US cents, up from 106.00 cents yesterday afternoon. By late afternoon the USD had picked up momentum and had pushed the AUD to 1.0580 down for the day.

Perhaps this is just some correction in the strength that we saw there in the US dollar. It’s come off a little bit early this week, and the Aussie and other crosses have settled accordingly.

The Aussie dollar began to tumble following the Reserve Bank of Australia’s release of the minutes from its March meeting.

In the minutes, the RBA said a strong mining sector was keeping the Australian economy buoyant despite weaknesses in some other sectors.

The markets have begun to position themselves ahead of Fed Chairman Bernanke’s speech later today. The USD is moving up against all of its trading partners.

Economic Reports for March 19 and 20, 2012 actual vs. forecast

|

Mar. 19 |

GBP |

Rightmove House Price Index (MoM) |

1.6% |

4.1% |

|

AUD |

RBA Governor Stevens Speaks |

|||

|

EUR |

Current Account |

4.5B |

4.3B |

3.4B |

|

EUR |

Italian Industrial New Orders (MoM) |

-7.4% |

-3.8% |

5.2% |

|

CLP |

Chilean GDP (YoY) |

4.5% |

4.2% |

3.7% |

|

Wholesale Sales (MoM) |

-1.0% |

0.4% |

1.0% |

|

|

USD |

NAHB Housing Market Index |

28 |

30 |

28 |

|

USD |

3-Month Bill Auction |

0.095% |

0.095% |

|

|

COP |

Colombian Industrial Production (YoY) |

4.5% |

2.4% |

|

|

Mar. 20 |

AUD |

CB Leading Index (MoM) |

1.1% |

-0.3% |

Economic Events March 21, 2012 that effect the AUD, NZD and JPY

15:00 USD Existing Home Sales

Existing Home Sales measures the change in the annualized number of existing residential buildings that were sold during the previous month. This report helps to gauge the strength of the U.S. housing market and is a key indicator of overall economic strength.

22:45 NZD GDP (QoQ)

Gross Domestic Product (GDP) measures the annualized change in the inflation-adjusted value of all goods and services produced by the economy. It is the broadest measure of economic activity and the primary indicator of the economy’s health.

Government Bond Auctions (this week)

Mar 22 10:10 Sweden I/L bond auction

Mar 22 10.30 UK Auctions 0.625% 2042 I/L Gilt

Mar 22 15:00 US

Announces auctions of 2Y Notes on Mar 27, 5Y Notes on Mar

28 & 7Y Notes on Mar 29

Originally posted here