By FXEmpire.com

AUD/USD Weekly Fundamental Analysis April 9-13, 2012, Forecast

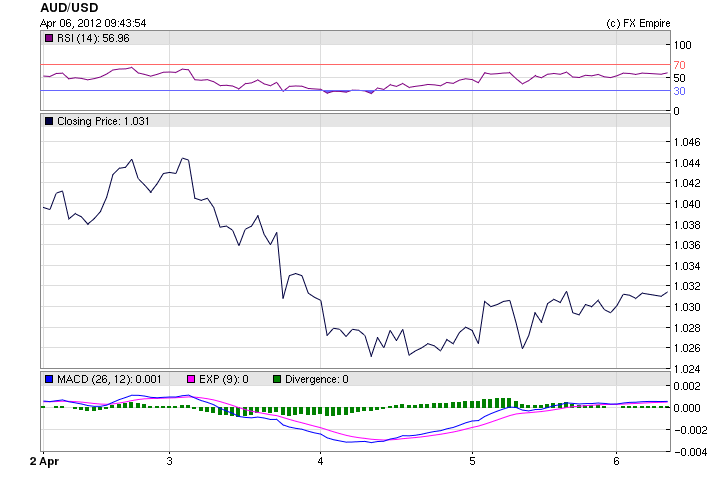

Introduction: The Australian dollar still isn’t in its good old days, but the performance is definitely improving. Resistance lines tend to work in a smoother manner than support lines, but they also work well. The pair move well together, not much volatility, but easy to chart and easy to trade with low risk factors

Weekly Analysis and Recommendation:

The AUD/USD ended Friday’s session at 1.0321 picking up steam after falling from the high of 1.0466 mid week. The Aussie traded as low as 1.0244

A rally on Chinese equity markets has helped the Australian dollar to recover from a three month low.

Many Chinese markets were closed during the week for local holidays. The local currency was at 84.74 Japanese yen, down from Wednesday’s close of 85.04 yen 78.36 euro cents, up from 77.88 euro cents.

The currency had received some support from Chinese stock markets, which reopened after three days of public holidays.

The Australian dollar fell sharply this week on weaker than expected trade data and signs the country’s central bank will cut the official interest rate as early as next month.

Data released on Wednesday showed Australia’s trade balance remained in deficit in February, despite widespread expectations of a return to surplus.

Against the USD this week, it was a difficult battle as FOMC minutes showed the Fed was no longer interested in QE, which gave the greenback strength and also make investors have to look at real value of currencies instead of trading central bank monetary policy.

|

Date |

Open |

High |

Low |

Change % |

|

|

04/06/2012 |

1.0321 |

1.0295 |

1.0322 |

1.0287 |

0.25% |

|

04/05/2012 |

1.0294 |

1.0278 |

1.0323 |

1.0253 |

0.16% |

|

04/04/2012 |

1.0279 |

1.0306 |

1.0312 |

1.0244 |

-0.26% |

|

04/03/2012 |

1.0306 |

1.0426 |

1.0466 |

1.0303 |

-1.15% |

|

04/02/2012 |

1.0426 |

1.0425 |

1.0445 |

1.0367 |

0.01% |

|

04/01/2012 |

1.0425 |

1.0451 |

1.0454 |

1.0425 |

-0.25% |

Economic Data for the week of April 2-6, 2012 for the Yen, the Aussie and the Kiwi actual v. forecast

|

Apr. 02 |

KRW |

South Korean CPI (YoY) |

2.6% |

3.1% |

3.1% |

|

JPY |

Tankan Large Manufacturers Index |

-4 |

-1 |

-4 |

|

|

AUD |

Building Approvals (MoM) |

-7.8% |

0.3% |

1.1% |

|

|

INR |

Indian Trade Balance |

-15.2B |

-13.0B |

-14.8B |

|

|

Apr. 03 |

AUD |

Retail Sales (MoM) |

0.2% |

0.3% |

0.3% |

|

AUD |

Interest Rate Decision |

4.25% |

4.25% |

4.25% |

|

|

AUD |

RBA Rate Statement |

||||

|

Apr. 04 |

AUD |

Trade Balance |

-0.48B |

1.00B |

-0.97B |

Economic Data from the USA for the week of April 2-6, 2012 actual v. forecast

|

Apr. 02 |

USD |

ISM Manufacturing Index |

53.4 |

53.0 |

52.4 |

|

Apr. 03 |

USD |

FOMC Meeting Minutes |

|||

|

Apr. 04 |

USD |

ADP Nonfarm Employment Change |

209K |

200K |

230K |

|

Apr. 05 |

USD |

Initial Jobless Claims |

357K |

355K |

363K |

|

Apr. 06 |

USD |

Nonfarm Payrolls |

120K |

203K |

240K |

|

USD |

Unemployment Rate |

8.2% |

8.3% |

8.3% |

Economic Events: (GMT)

Economic Highlights of the coming week for the USA (only minor reports, a very light week)

|

Apr. 9 |

15:00 |

USD |

CB Employment Trends Index |

107.50 |

|

Apr 10 |

12:30 |

USD |

NFIB Small Business Optimism |

94.3 |

|

13:55 |

USD |

Redbook (MoM) |

0.70% |

|

|

15:00 |

USD |

Wholesale Inventories (MoM) |

0.5% |

0.4% |

|

15:00 |

USD |

IBD/TIPP Economic Optimism |

47.5 |

|

|

21:30 |

USD |

API Weekly Crude Stock |

7.85M |

|

|

21:30 |

USD |

API Weekly Gasoline Stock |

-4.46M |

Economic Highlights of the coming week that affect the Yen, the Aussie and the Kiwi.

|

Apr. 10 |

02:30 |

AUD |

NAB Business Confidence |

1 |

|

23:00 |

NZD |

NZIER Business Confidence |

||

|

Apr. 11 |

02:30 |

AUD |

Home Loans (MoM) |

-1.2% |

|

Apr. 12 |

02:30 |

AUD |

Employment Change |

-15.4K |

|

02:30 |

AUD |

Unemployment Rate |

5.2% |

Originally posted here