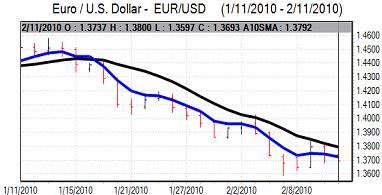

EUR/USD

The Euro was unable to make any fresh move towards the 1.38 level against the dollar on Thursday and dipped weaker during the day as confidence remained fragile ahead of the EU summit on Greece’s debt situation.

The EU stated that it would provide determined and co-ordinated action to support Greece if needed. There were no major details provided at this stage with further details set to be announced next week. The support would be dependent on committed budget action by the Greek government.

There was some disappointment over the lack of detail and also some fears that support would be blocked by the German parliament. In an initial reaction, the Euro fell sharply with a low close to the 1.36 level before a recovery back to the 1.3670 region. From a longer-term perspective, there will be continuing fears that support measures will cause moral hazard problems and weaken budget resolve within the Euro area. Underlying confidence in the currency is, therefore, likely to remain fragile.

The latest US jobless claims data was stronger than expected with a decline to 440,000 in the latest reporting week from a revised 483,000 previously. There have been distortions caused by seasonal factors over the past few weeks and these may now have worked their way through the system and the lower claims figure will provide some dollar support.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar again hit resistance just above the 90 level on Thursday and edged weaker towards the 89.60 region, although ranges were generally narrow.

Demand in the latest US Treasury auctions remained slightly lower than expected and this will tend to have some negative impact on the dollar, although the impact should be measured with the US currency still looking to gain underlying support on yield grounds.

Confidence in Euro-zone assets remains generally weak and this will continue to provide some defensive support for the Japanese currency, especially against the Euro. Overall risk conditions remain slightly stronger which may make it difficult to secure a decisive yen trend in the near term.

Sterling

Sterling was again subjected to choppy trading conditions during Thursday. General dollar strength pushed it to lows near 1.5550 against the US currency, but it then rallied strongly to a peak above the 1.57 level. There was support from significant Euro selling against Sterling during the day.

The Euro-zone vulnerabilities will continue to have a mixed impact on the UK currency. The Euro-zone weaknesses could have a positive impact on Sterling as investors look to move away from the Euro. In contrast, persistent fears surrounding government debt and sovereign ratings would tend to be a negative factor for the UK currency as domestic vulnerabilities would be highlighted.

There were no major domestic developments during the day. The inflation data will be watched closely next week for further evidence on price trends within the UK economy and whether the Bank of England is being complacent over the situation. The main feature is likely to be a sustained increase in volatility.

Swiss franc

The dollar gained strongly in US trading as the Euro was subjected to strong selling pressure and there was a US currency peak around 1.0780. The franc regained some ground late in the US session and consolidated around 1.0720. The Euro was generally weaker against the franc and tested support levels towards 1.4650.

A lack of confidence in the EU support proposals surrounding Greece will tend to maintain defensive support for the Swiss currency against the Euro.

The latest Swiss inflation data was stronger than expected with prices declining by 0.1% in January to give a 1.0% annual increase. The higher than expected figure may have some impact in lessening National Bank fears over the implications of franc strength.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Australian dollar

The Australian dollar has maintained a strong tone over the past 24 hours as it continued to gain support from the much stronger than expected employment data. There will be strong expectations of a Reserve Bank interest rate increase in March which will continue to provide important support for the currency.

Trends in risk appetite will also be important and it may be difficult for the currency to secure further strong buying support.