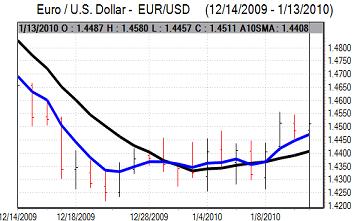

EUR/USD

Regional Fed President Plosser stated that rates would need to rise well before unemployment fell to acceptable levels, but there were still major doubts whether the Fed would tighten policy given the underlying economic stresses. The Euro was near the 1.45 level in early Europe on Wednesday as narrow ranges initially dominated before pushing to a high around 1.4575.

The ECB will hold its first meeting of the year on Thursday. There is very little of a change in interest rates at this stage, although there is likely to be some warning over the need to maintain medium-term price stability.

The meeting will, however, certainly be very important for the Euro with a particular focus on ECB President Trichet’s press conference. The ECB will have to address the issue of monetary policy and also the implications of structural weakness in the weaker Euro-zone economies such as Greece.

The most likely outcome is that the ECB will take a generally hard-line stance on Greece with a particular focus on debt restructuring. The central bank will also be extremely wary of giving the impression that there will be any bailout for Greece or other member countries.

Confidence in the Greek deficit-reduction plans remained weak and the Euro retreated back to below the 1.45 level in US trading with significant selling pressure on the crosses.

The Fed’s Beige Book reported some improvement in conditions in most districts, but sentiment was still generally fragile and there will be particular unease over a further tightening of credit conditions. A firm retail sales report on Thursday would provide some degree of support for the dollar.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

There are still major doubts over Japan’s fiscal policy under the new government and this will tend to undermine confidence in the yen as well, especially given underlying fears over the longer-term debt profile.

The dollar found further support below the 91 level against the yen during Wednesday, but was unable to make much headway as there was still a more cautious attitude towards risk with Chinese equity markets weakening.

The US currency continued to find some support below the 91 level against the yen and edged higher to 91.40 as uncertainty persisted over the Japanese currency’s medium-term direction.

Sterling

Bank of England MPC member Sentence warned over the risk of higher inflation in the medium term and the potential need for higher interest rates during 2010 which provided additional Sterling support and it tested technical resistance levels above 1.62 in early Europe on Wednesday.

Industrial output rose 0.4% in November as energy output gained, but manufacturing output was unchanged over the month.

The NIESR reported a 0.3% increase in GDP for the fourth quarter of 2009 which should mean that the official figure will also register growth and an end to the recession which will underpin the UK currency sentiment with further speculation over an early in crease in interest rates.

There was significant Sterling support against the Euro and the UK currency was able to push to highs near 1.63 before consolidating just below this level while the Euro weakened to near 0.89.

Swiss franc

The dollar found support below the 1.0140 level against the Swiss franc on Wednesday, but again stalled above the 1.02 level during the day. The Euro was able to edge higher against the franc, but failed to make much headway during the day.

A lack of confidence in the Euro-zone economy should continue to provide some protection to the Swiss franc against the Euro and on the crosses, especially if the ECB voices concerns over the situation in the peripheral Euro-zone economies.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

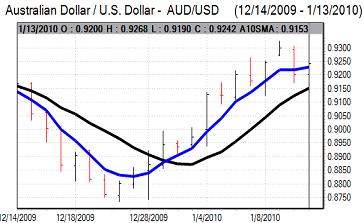

Australian dollar

The Australian dollar was able to regain ground on Wednesday and pushed back to test resistance levels above 0.9250 as the US currency stumbled while commodity prices looked to recover.

Underlying confidence will remain firm which will continue to lead to further buying support on dips, but the currency was unable to gain any further support during the day with some evidence of selling pressure on the crosses which hampered the Australian dollar against the US dollar.