Yesterday:

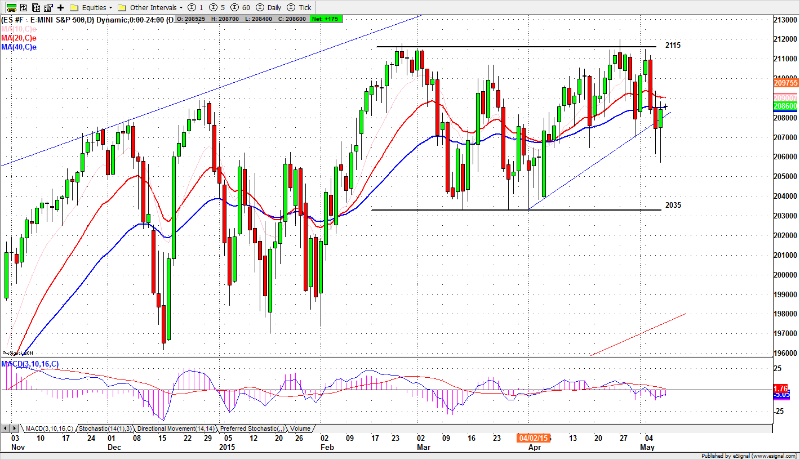

The S&P500 mini-futures (ES) bounced a little on Thursday, enough to recover some of the ground lost in Wednesday’s sell-off, but not enough to calm the jittery Bulls. The futures closed at 2084.25, or 10 points above the previous day’s close, on moderate volume.

The ES dropped dramatically overnight but found support after the market opened, and marched steadily up into the close. The price action was bullish and the high close regained about half of the previous loss. But the ES still made a lower high and a lower low, which doesn’t demonstrate a change in the sour outlook created by the previous sharp sell-off. The plunge may have gone a little too far, but Thursday didn’t fix it.

Today:

There are two elements that will crank the futures around today (Friday). One is the Non-Farm Payroll report this morning; the other is a re-balancing of equity option positions as we move toward the weekly option expiration at the end of the day.

Individual Non-Farm Payroll reports are largely useless; the series of reports over time may reveal interesting economic trends, but any individual report can be wildly wrong. They are often corrected in subsequent weeks as more data becomes available.

But traders — especially the high-frequency bots — just love them, because they are always a handy excuse for manipulating prices up or down. Tomorrow’s report won’t mean much by itself, but it will move the market.

The option imbalance is a little different. The Wednesday sell-off changed the dynamics of the weekly options and pushed the balance point lower, to around 2075. Puts and Calls are going to be pushed around as traders try to re-balance their positions. The likely outcome is that the ESM5 will whipsaw back and forth between a maximum upside of 2100 and a max downside of 2060.

2090.50-88.50 is a key zone for today. A move above 2091.75 will be bullish and could trigger a short squeeze to push the price up to 2095.50-97.00 .

Conversely, if the ES fails to break through the key zone after the Payroll report is released, it is likely to move back down to test Thursday’s low in the 2068.75 area.

2064.50-62.50 is a control zone for the downside movement. A move below this control zone will be bearish. It could trigger more selling to push the price below the 2059-56 zone.

Major support levels for Friday: 2062-59.50, 2051.00-53.00, 2045-42.75, 2029.25-28.50;

major resistance levels: 2096.75-95.50, 2101-03.75, 2123.25-21.50

###

Naturus.com publishes a free weekly analysis of US equity indices. You can get on the

mailing list at this link.

Related Reading: