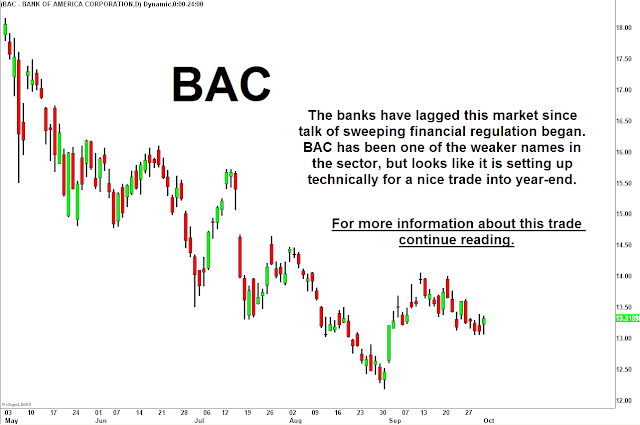

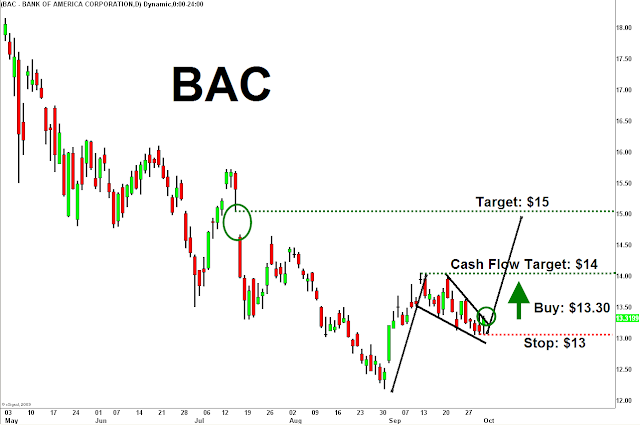

Over the course of the last two years bank stocks have gotten slammed, and new financial regulation put a damper on the burgeoning rally in the sector. Bank of America was one of the hardest hit banks by the crisis, and has lagged even within a weak sector. In general, our strategy is to trade leading sector stocks, but every once in a while we note technical patterns in weaker stocks that warrant a look. BAC looks to be a great value buy in this area, with a calculated risk-reward parameter based on the descending channel pattern. Money has begun to rotate somewhat out of high beta tech into oil stocks, and the next stop could be the financials. We have seen some money come into the sector today, and actions of many insiders at Bank of America indicate the stock is undervalued, with CEO Brian Moynihan purchasing 30,000 shares in late August, his first stock purchases since taking over at the beginning of the year.

Uncategorized