by Mike Sabo

Options on futures offer the savvy trader a multitude of potential speculative and hedging strategies, with a multitude of different risk profiles. I’m going to outline a few basic bullish strategies you might pursue. Keep in mind, these strategies might not be appropriate in every market, or in every situation.

At the most basic level, you should understand there are two types of options–puts, and calls. All options have a defined expiration date. The buyer of a call option gains the right, but not the obligation, to purchase the underlying futures contract at a specified price (strike price) within a specified time (on or before the expiration date). The buyer of a put option has the right, but not the obligation, to sell the underlying futures contract at the specified strike price on or before the expiration date. The call buyer therefore expects the market to rise and the put buyer expects the market to decline.

For every buyer in options, there is a seller. The call seller is obligated to sell the underlying futures contract at the specified strike price, while the put seller is obligated to buy the underlying futures contract at the specified strike price. The buyer pays money to purchase the option, and the seller collects it. This money is known as premium. The most money the option buyer can lose is the premium, while the most money the seller can make is the premium. On the flip side, the option buyer can make unlimited potential profit, while the seller faces potentially unlimited losses. It would seem as if buying an option is the better deal, but we’ll see why that’s not always the case. Buying and selling options simply have different risk profiles.

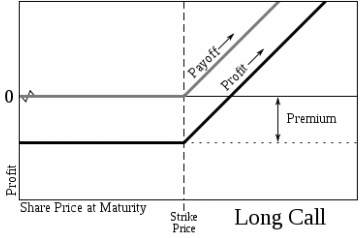

Long Call

The long call is the most basic options strategy. If you thing that the price of the underlying futures contract will rise significantly beyond the strike price before the option expiration date, you could buy a call option.

As mentioned, the call option gives you the right to buy the underlying at expiration, but not the obligation. You can make unlimited profit potential, with defined risk. However, statistically, about 80 percent of all options purchased and held to option expiration expire worthless–that is, they are out-of-the-money at expiration and have no value. If that happens, you lose the premium you paid for the option, and nothing more. That’s not to say you should never buy options, however. If there is extreme volatility in the market, or you expect extreme volatility, this strategy could work for you.

Let’s look at an example. If corn is trading at $6.30 a bushel and you expect it to rise, but don’t want the unlimited risk of a long futures position, you could buy a $6.30 call instead. Perhaps it costs $500 to buy that call, which gives you the right to buy a futures contract at $6.30 until option expiration. You need corn to not only rise above $6.30 to profit, but you also need it to rise far enough to cover the cost of buying the option, and your commissions. If on expiration day the market is below your strike price, say $6, your call is out of the money and expires worthless. You are out your $500, plus your commission costs. However, if you’d bought a futures contract instead, your loss would be much greater. So that’s where traders view options as having an advantage.

In reality, different factors work to keep the risks balanced between buyers and sellers. Options that are near-the-money are going to be more expensive than those that aren’t. Time decay works in favor of an option seller, so he or she may see more winning trades. However, one setback can quickly wipe them out, and then some. On the other hand, the option buyer may have a series of losing trades, then find a big winner. In theory, the market prices options so that there is no “better” side to be on over time.

Also keep in mind, in most options contracts, you don’t have to hold a position until expiration. If it is not going your way, you can offset it and exit the trade.

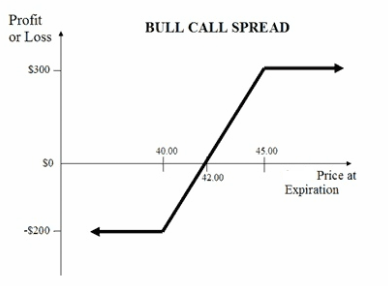

Bull Call Spread

Another approach is the bull call spread, or vertical call spread. You would use this strategy if you think the price of the underlying asset will go up moderately in the near future, but probably not dramatically. Bull call spreads can be implemented by buying an at-the-money call option while simultaneously selling (also known as writing) an out-of-the money call option of the same underlying instrument with a higher strike price, and the same expiration month.

For example, you would buy a December $7 corn call and sell a December $8 call. This strategy has defined risk, and also defined profit. That means you know exactly what your maximum loss could be if this trade moves against you, and also what your maximum potential profit would be. This strategy offers some relief of the time decay you would face with a simple call purchase, because time typically erodes the value of the call you sold.

Ratio Spread

Ratio Spreads involve buying and selling unequal numbers of calls. For example, buying one $7 corn call and selling two $8 corn calls. Unlike the bull call spread, this strategy carries unlimited risk. Your one corn call you bought “covers” one corn call you sold. However, you would be “naked” one additional $8 corn call that you sold and your risk on this one is defined as unlimited. You are selling something you don’t actually own, so at expiration, you could be assigned a futures position in corn you might not want, and face a potential loss. For example, if corn rises to $9 at expiration, (your breakeven point on the upside) you would then be short a futures contract at $8. However, there are techniques to help mitigate the risk of this naked position. This strategy can save on your trading costs if the market moves completely in the opposite direction-meaning below $7.

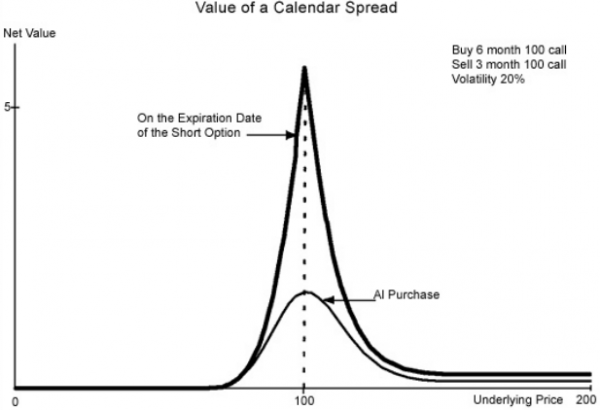

Bull Calendar Spread

Let’s say it’s October, and you are long-term bullish on the corn market. You might want to buy a March out-of-the money call, but given the time involved, that call is likely to be a bit expensive. What you can do is buy the call, but simultaneously sell an equal number of near-month calls of the same underlying futures contract, with the same strike price.

The trader employing this strategy is bullish for the long term, and is selling the near-month calls to collect premium. Therefore, the cost of the long-term calls purchased will be lowered, or even possibly covered by the option premiums you sell. You might buy a $7 March corn call, and sell a December $7 call of that same year. There is risk involved, but this strategy can be advantageous to establish a long-term position. It gives the market a lot of time to move to your desired level while helping to offset the cost or potentially cover all of the cost of the long option.

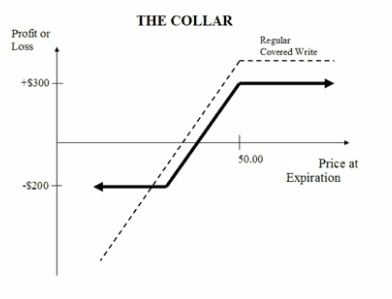

Collar

A collar is an options trading strategy that is constructed by holding the underlying futures contract, while simultaneously buying protective puts and selling call options against that holding. The puts and the calls are both out-of-the-money options having the same expiration month and must be equal in number of contracts.

Let’s look at an example. Let’s say December corn is trading at $6.45 a bushel, and you are long one December corn contract at $6.30. You think the price of corn will keep moving up, but there is a big USDA crop report coming out, and you are concerned it could be bearish in the short-term. You might sell a $6.60 call option and collect premium. You then use that premium to purchase a $6.30 put option. The put option now gives you the right to sell December corn at $6.30, while still maintaining your long futures position at $6.30. You have upside potential, but you’ve capped it. If the market rises above $6.60, your futures position can be called, but you still make 30 cents on the trade. If corn fell dramatically, to $6.05 perhaps, you have the right to sell a futures contract at $6.30, and collect 25 cents. So you have some upside potential, and also protection on the downside. You can establish a collar when you put your initial futures position on, or add it later.

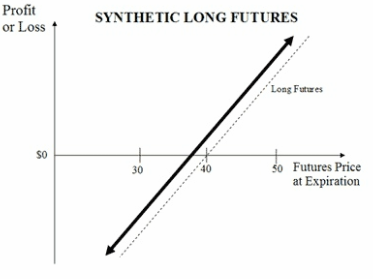

Synthetic Long Futures

This strategy can be used to simulate a long futures position, but using options to reduce the risk profile. (Remember, with all futures contracts, you can lost more than your initial investment) A synthetic long position is entered by buying at-the-money call options and

selling an equal number of at-the-money put options of the same underlying futures and expiration month. This strategy offers unlimited potential profit as well as unlimited risk. It can be created to hedge a short futures position, and often as a means to profit from an arbitrage opportunity.

This position involves the concept of delta. The delta is the rate of change the option experiences in relation to the underlying instrument. If an option has a delta of 50, and corn prices move 10 cents, that means the option should see 50 percent of that move, or gain 5 cents. An at-the-money option generally has a delta of 50, and as you move out of the money, the deltas will decrease. And, deltas will generally change on a daily basis depending on the change of price in the market.

Let’s look at an example. December corn is trading at $7 a bushel, and you sell a $7 put and buy a $7 call. The put and call have a delta of 50 percent. If corn jumps 10 cents, the put value should drop 5 cents, and the call value should rise 5 cents. You might instead sell a $6.80 put to give room to the downside, then buy an out-of-the-money call. These have different deltas, and can give you a downside cushion if you are wrong. Selling the put leaves you naked. Remember, the risk is unlimited with naked options, so it might not be suitable for your situation. You can benefit from unlimited profit potential on the call, however.

I encourage you to work with a professional to help you formulate a specific strategy for your unique goals and risk tolerance. Once you understand how they work, options can be powerful tools in your trading and investing arsenal.

Please feel free to call me to discuss this strategy in further detail, or with other questions you might have about the markets.

Mike Sabo is a Senior Market Strategist with MF Global. He can be reached at 800-798-7671 or via email at msabo@mfglobal.com.

Futures trading involves the substantial risk of loss and is not suitable for all investors. Past performance is not necessarily indicative of future trading results. Trading advice is based on information taken from trade and statistical services and other sources which MF Global believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder.

(C) 2011 MF Global Holdings Ltd. All Rights Reserved.

Futures brokers, commodity brokers and online trading. 141 W. Jackson Blvd. 1400-A, Chicago IL 60604. wwww.mfglobal.com/individual-trading