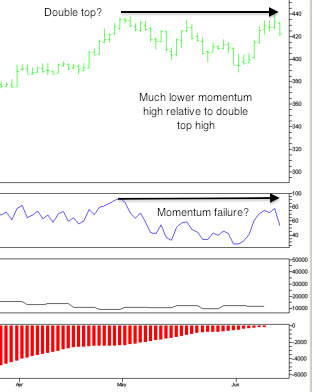

July soybean meal futures have been consolidating near their highs for the last month. Momentum has stalled and positions have unwound towards neutral.

Commercial traders have been taking a bearish tone towards the market that was confirmed by yesterday’s failure. Yesterday’s decline saw the market fail on much lower momentum reading in the ARSI indicator.

We will use this as an opportunity to side with commercial traders and place ourselves on the short side of the market. As always, we will be placing a protective stop at the swing high of 439.9

Commitment of Traders Trading Signals

ANDREW WALDOCK

866-990-0777

This information is not to be construed as an offer to sell or a solicitation or an offer to buy the commodities herein named. The factual information of this report has been obtained from sources believed to be reliable, but is not necessarily all-inclusive and is not guaranteed as to the accuracy, and is not to be construed as representation by Commodity & Derivative Adv. The risk of trading futures and options can be substantial. Each investor must consider whether this is a suitable investment. Past performance is not indicative of future results.