By FXEmpire.com

Bernanke Sends USD down and Gold Up

Once again, Fed Chairman Bernanke sent the dollar plummeting and gold soaring. Many investors have begun to trade the Bernanke System. Each time he speaks he either pushes gold up or down and the opposite to the USD.

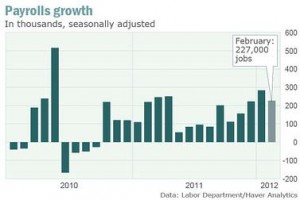

In his surprising speech today, Bernanke said “reiterated themes that Federal Reserve policy makers have used to justify policy accommodation since last summer,” wrote economists at Nomura Global Economics, who said the arguments used by Bernanke — largely pointing to weakness in the labor market despite some recent signs of improvement — support further policy action.

Investors have been searching for clues to prospects for further monetary stimulus measures by the central bank, which tend to undercut the dollar. Recent remarks by Fed officials and the statement issued by the rate-setting Federal Open Market Committee earlier this month were seen underlining notions the central bank would refrain from further stimulus, which could include expanding its bond-purchase program in some form.

In a speech to the National Association for Business Economics, Bernanke said he wasn’t yet sure that recent improvement in the labor market can be sustained.

Gold climbed almost 27.00 to trade at 1691.70 as the USD fell against most of its trading partners, the euro moved from 1.3191 to break above the 1.33 line reaching as high as 1.3344.

The weakened dollar helped push up the price of crude oil to trade at 107.11

The USD fell against the CAD, the AUD and the GBP. The sterling almost broke through the 1.60 level ending at 1.5945, with virtually no news or data out in the UK today.

Elsewhere around the globe today,

New Zealand’s trade balance was back in surplus in February, though the government statistician said weaker than expected imports and exports may have been impacted by escalating industrial action around the country.

New Zealand’s trade balance was back in surplus in February, though the government statistician said weaker than expected imports and exports may have been impacted by escalating industrial action around the country.

The trade balance was a surplus of $161 million in February, turning from a revised deficit of $159 million a month earlier, according to Statistics New Zealand.

China’s bank lending has been slow in the first two months of the year due to weak demand for loans, but China should still see an increase in new bank lending this year, the recently retired chief banking regulator said Sunday.

Vietnam’s economy is likely to rise 4% during the first quarter, slower than during the same period of recent years, a senior government official said Sunday in Hanoi. “Though the economy is still growing, the pace of the growth is slower.

Across to Europe:

News that Germany will back a temporary increase in euro-zone funds to help prevent the debt crisis in the bloc’s periphery from jumping to other member states, with officials in Berlin  signaling support over the weekend, according to a report Monday

signaling support over the weekend, according to a report Monday

Also in Germany The Ifo Institute’s German business climate index unexpectedly rose to 109.8 in March from a slightly upwardly revised 109.7 in February, news reports said Monday. Economists polled by FactSet Research had forecast a reading of 109.6.

The Spanish government on Sunday failed to secure a majority in an election in Andalucia, which may make it harder for Prime Minister Mariano Rajoy to push through austerity measures in that region to cut the country’s deficit.

Separately, Italy Prime Minister Mario Monti reportedly said Spain could reignite the euro-zone debt crisis if it fails to impose austerity measures.

Spain has been beginning to take center stage as the focus of the European Debt Crisis.

Originally posted here