Everything says the market should be falling except the market. As a trader one can be continually humbled.

We’ve been calling for a correction for the past several weeks and it appears we received another minor pullback. Similar to last year’s start of the rally around Thanksgiving, the market is going higher on very light volume.

We decided to take short position against the major indices after the brief sell-off a few weeks ago and have been on the wrong side of that trade. Our tactical planning is now in question.

TACTICAL PLAN

When speaking of our tactical strategy, we allude to our shorter-term plan of action (one to three months) within our longer-term plan of action (one to three years). When crafting our tactical strategy, our thesis revolves around our proprietary behavioral model.

CAPTURES EMOTIONS MATHEMATICALLY

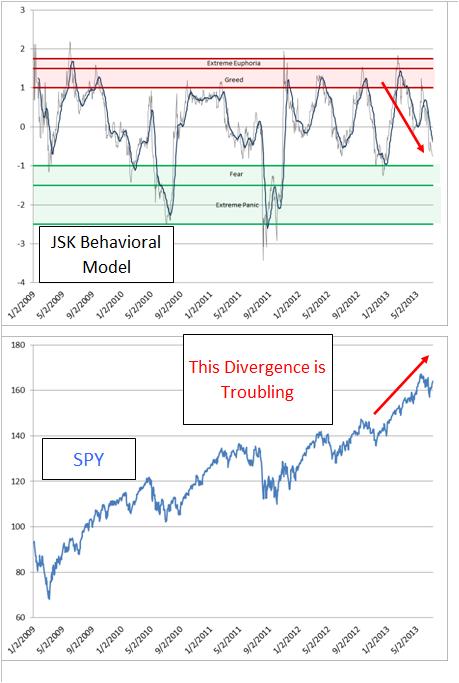

Our Behavioral Indicator attempts to capture human trading emotions mathematically. It combines years of data from various indicators and aggregates it into an easy to understand model that assists in the investment decision making process.

FIVE CYCLES

Our indicator will score within one of five basic Market Cycles. These cycles include “Extreme Euphoria,” “Greed,” Rational Market,” “Fear,” and “Extreme Panic.” Depending on where we are in the market cycle determines how aggressive our portfolio structure. Typically, the best time to aggressively buy U.S. equities is when we are rising out of Extreme Panic. The best time to be conservative is when we are falling from Extreme Euphoria.

DIVERGENCE

Our behavioral model looks at the strength of market trends using volume. An up day on very light volume will not get the same weighting as an up day on strong volume. The past several weeks, the market has been heading higher on very light volume (adjusted for seasonality) and we are starting to see a big divergence in the numbers.

Without looking at the stock chart, the figure below shows the trigger line (gray) in our model has approached levels that would make one think we are in the middle of a correction. That is clearly not the case and is troubling.

BOTTOM LINE

We try to remain as logical as possible when trading and keep our emotions in check. A bruised ego is easier to deal with than an angry client with losses in the account.

We will be watching the volume closely over the next few days. Should volume pick up and our model start sloping positive once again, we have no choice but to admit an error in our analysis and get on the right side of the trade.

= = =

Follow Joseph S. Kalinowski, CFA on Twitter: @jskalinowski