Today is the Big Kahuna – the Non-Farm Payroll Report.

Today is the Big Kahuna – the Non-Farm Payroll Report.

GS has been predicting 475,000 jobs lost, a pace of “only” 5.7M per year and they (since they have jobs) think that’s plenty of reason to celebrate and what better way to celebrate than driving down to our local gas station and filling up for $3 a gallon again. Yes, good times are back indeed! Although the dollar made a 1.5% recovery in the last 2 days, oil has gone up another 4% yesterday and has been jammed all the way back over $69 in pre-market trading. This time we’re thrilled because we turned our negative play into a bull-put spread, selling higher puts than we own so we are playing for a higher open and then a sell off (but it’s a half cover just in case the jobs report is bad).

This offsets much of our upside pain to the puts we sell. In this case, we are back in theUSO $35at.55 and USO July $35 puts with an average entry of $1.25. I had sent out an Alert to Membersearly in the morning looking to cover with the $38 puts at $1.50 and we also, a little bit later, the June $39 puts for $2 as well. The idea ofcovers like this is that the higher puts have a higher delta than your puts, so they lose more money than you do when the move goes against you. Then, when the move is over (we expect oil to go as high as $70 but we flipped to a 1/2 cover at $69.50 as I called a nice top for the day in our 2:05 Alert), we buy back the puts we sold and we caneven use that profit to improve our own position. Sellinga $1.50 or $2 put against our .55 puts (protected by our July puts) means we will have a free trade in June if we can buy back those puts for .55 less! Option trading is very fluid, always be aware of that – there are some trades that can be left alone and some that need to be fussed over – oil trading is absolutely in the latter category!

Of course we don’t just bet one way either. We took VLO as a long but otherwise pretty much sat on our hands yesterday as we thought the jobs report this morning could go either way. Tyler from Zero Hedge put up an article in the afternoon that put me off trading, showing GS accounted for 33.7% of allNYSE buy + sell volume last week. And here we are fighting them! I said to members, this is like playing Hold-Em poker where you get 2 cards and they get 17. Yes, it is possible that you can win a few hands but, at the end of the day, no one is expecting you to be the winner! So I’m not going to b***I’m not going to complain – if you’ve been reading what I’ve written on the subject this past week and you are not angry enough to spend 5 minutes sending an EMail to your Congressmen, just to ask them to look into this then why should I worry about it?

Of course we don’t just bet one way either. We took VLO as a long but otherwise pretty much sat on our hands yesterday as we thought the jobs report this morning could go either way. Tyler from Zero Hedge put up an article in the afternoon that put me off trading, showing GS accounted for 33.7% of allNYSE buy + sell volume last week. And here we are fighting them! I said to members, this is like playing Hold-Em poker where you get 2 cards and they get 17. Yes, it is possible that you can win a few hands but, at the end of the day, no one is expecting you to be the winner! So I’m not going to b***I’m not going to complain – if you’ve been reading what I’ve written on the subject this past week and you are not angry enough to spend 5 minutes sending an EMail to your Congressmen, just to ask them to look into this then why should I worry about it?

As I often say to members, we don’t care IF the markets are rigged, as long as we can figure out HOW they are rigged and play on the side of the guys who are rigging it, we can make very good money. The rest of you are on your own!

So we are still generally bearish as the retail report truly sucked (see chart above) and the jobs report may be better but it includes a lot of short-term Census hiring so those jobs now will be more unemployed people in the fall. We didn’t make our 40% levels yesterday and, if we don’t make them today we have a nasty technical top, not the “breakout” the MSM is trying to shove down your throat. Also, how pathetic is it that GS pulled out all the stops and couldn’t get oil over $70 yesterday?

So we are still generally bearish as the retail report truly sucked (see chart above) and the jobs report may be better but it includes a lot of short-term Census hiring so those jobs now will be more unemployed people in the fall. We didn’t make our 40% levels yesterday and, if we don’t make them today we have a nasty technical top, not the “breakout” the MSM is trying to shove down your throat. Also, how pathetic is it that GS pulled out all the stops and couldn’t get oil over $70 yesterday?

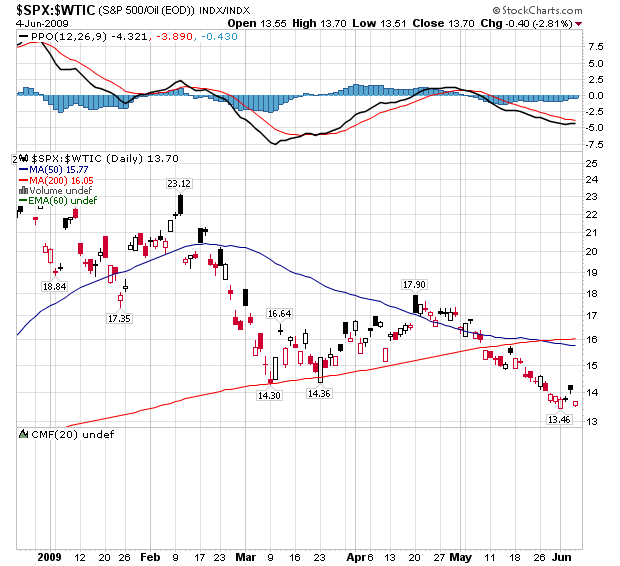

8:30 Update: ONLY 345,000 Jobs lost. A MASSIVE beat. BUT unemployment is UP to 9.4%, also a big beat over the 9.2% expected. This makes little sense really but the market jumped 1% on the news immediately and that’s all the NYSE and the S&P needed to get over the 40% mark. Oil punched right over $70 so congrats to GS and too bad for our oil putters, who we’ll be buying out in the morning excitement. While S&P 950 is very exciting, I do want to draw your attention to the following chart, which represents the S&P 500 priced in barrels of oil :

WTF? That’s right, we are now lower than our March 9th lows so unless your portfolio is almost 100% oil, like our masters at Goldman Sachs, you have lost ground. And what are your friendly media pundits urging you to do right now? They are telling you to sell your stocks at their relative lows and buy oil and oil stocks at their relative highs. Bend over and say “Baaaaaahh!” What does that mean? It means that, those who do have the oil that they bought with our TARP money can now cash in their oil, crash the market even lower and then buy up stocks at EVEN LOWER relative prices than they had in March. See, who says it was only a once in a lifetime opportunity – when you control 1/3 of the market you can do this stuff quarterly!

Have we called the rigging correctly? I’ve been saying since last week that “THEY” are going to run oil as much as$70 (our original scale-in targetswere $66, $68, $70) and then tank the markets and we may have been a little early with our entries (I did not count on Goldman’s $85 call on oil yesterday to give that extra push) but I don’t see anything in the above chart to convince me that I’m wrong about the game plan. We can still go lower (ie. oil can go higher relative to the markets) but probably not much more or we’re going to wipe out the country and I can’t believe even GS would want to kill the goose that lays their golden eggs.

Have we called the rigging correctly? I’ve been saying since last week that “THEY” are going to run oil as much as$70 (our original scale-in targetswere $66, $68, $70) and then tank the markets and we may have been a little early with our entries (I did not count on Goldman’s $85 call on oil yesterday to give that extra push) but I don’t see anything in the above chart to convince me that I’m wrong about the game plan. We can still go lower (ie. oil can go higher relative to the markets) but probably not much more or we’re going to wipe out the country and I can’t believe even GS would want to kill the goose that lays their golden eggs.

Now we have an interesting dynamic because, if you take this jobs report at face value, the dollar should improve substantially and that can be a real drag on commodities, one of the factors we were counting on in our bearish call on oil. Our logic was – either it’s a bad jobs report and oil goes down or it’s a good jobs report and the dollar goes up (Feds mandate is based on job creation so more jobs = less Fed money creation – hopefully). Also helping the dollar is the spiraling government crisis in the UK we’ve been keeping tabs on for weeks, which has now gotten to the point where they are calling for Brown’s resignation and there will almost certainly be an election forced over this issue – very bad for the Pound! Congrats to our Pound bears, by the way, for nailing that one! This is what we do as funamental traders – we read the news and we think and then we trade. It’s homework and buy, as opposed to buy and homework espoused by others…

Even a fundamentalist has to know when they are licked, however, and I said to members yesterday “We have to toss our brains out the window and join the party if they break technicals tomorrow so watch some cartoons or something and get in the mood.” I hope everyone has their buying shoes on because we’ve got a boatload of cash burning a hole in our pockets and if we can make our S&P (946)and NYSE (6,232) levels today and hold them on Monday – it will finally be a new level we can use as a stop and BUYBUYBUY!

Even a fundamentalist has to know when they are licked, however, and I said to members yesterday “We have to toss our brains out the window and join the party if they break technicals tomorrow so watch some cartoons or something and get in the mood.” I hope everyone has their buying shoes on because we’ve got a boatload of cash burning a hole in our pockets and if we can make our S&P (946)and NYSE (6,232) levels today and hold them on Monday – it will finally be a new level we can use as a stop and BUYBUYBUY!

Either way, this will probably be our last sideline day after 3 weeks of hanging in cash. Depending on the technichals now, next week we will be ready to make a general bullish or bearish call but I don’t know which until we see how our lines are handled and we have a lot of work to do on our weekend reading list as we try to sift through the BS and figure out what is real and what is not. If we can’t break our final 40% levels on that jobs news – Brain stays on and we very likely go bearish. If we make and hold our numbers then school’s out for summer and we’re gonna have fun, fun, fun until Daddy takes our T-Bird away!

Have a great weekend!

– Phil