Keeping an eye on the currencies of big commodity producing nations not only provides us insight into demand for commodities but the health of emerging markets as well.

Canadian Dollar (CAD) was turned back at the 38.2% retracement of the 2012 decline (part of the 2011 bear market). With the break of the bear flag last week it appears the bear market rally is over.

Figure 1 Canadian dollar

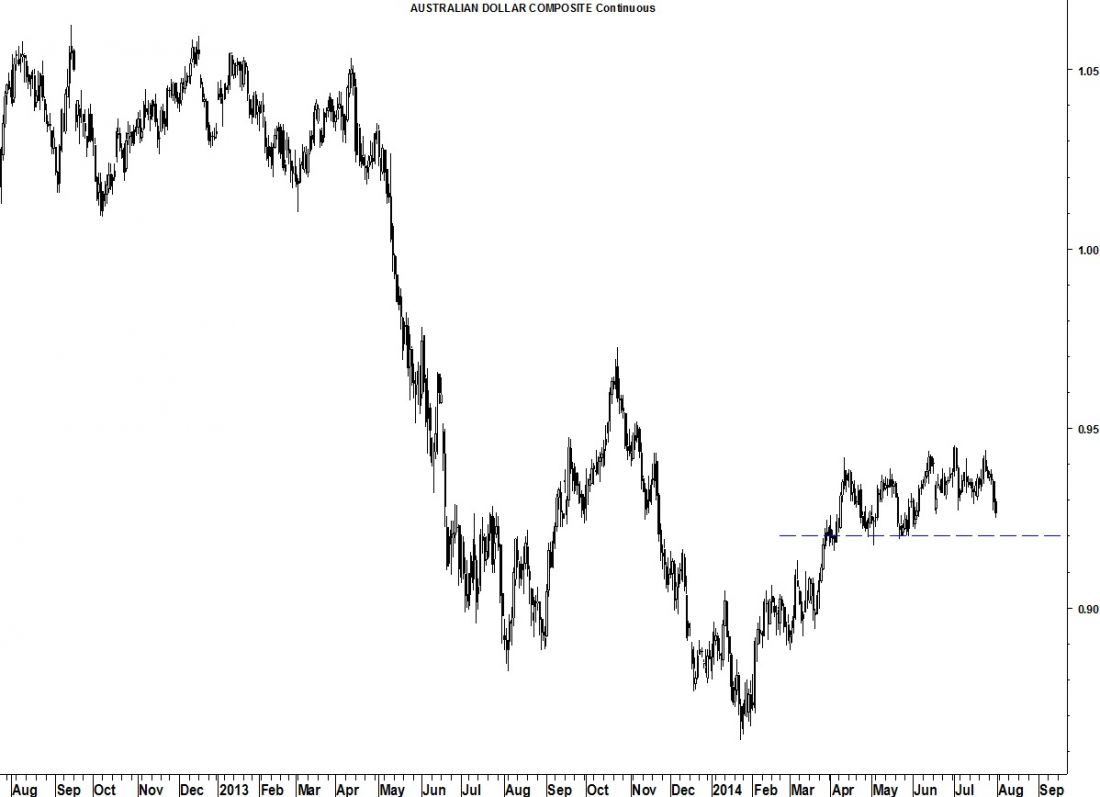

Australian Dollar (AUD) has been like watching paint dry since April. As long as support at 0.92 remains intact we have to assume the bear market rally is too. But with the break down in the CAD the Aussie is probably on borrowed time.

Figure 2 Australian dollar

The secular bear cycle in commodities is due to end near the end of this year.