The Golden Sunrise

The essential morning read for investors!

Golden Sunrise is the Golden Surveyor’s broad-based market and world view.

Written daily 4am-7am by markets information specialist GS John

Today’s Golden Sunrise

Wednesday, May 19, 2010

Hours of daily research consolidated for you

Blood in the Water-Yours?

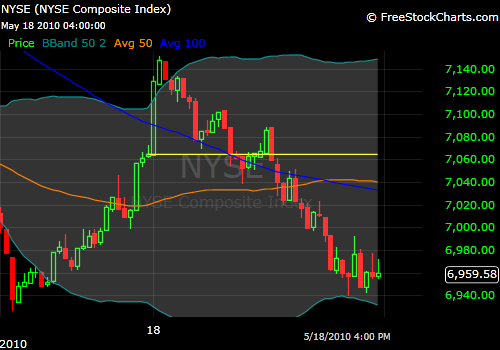

Tough day in the market yesterday…following the nice move up on Monday following the tough start to the week, the broadest index NY Composite move up sharply and then…story on a 10 minute chart.

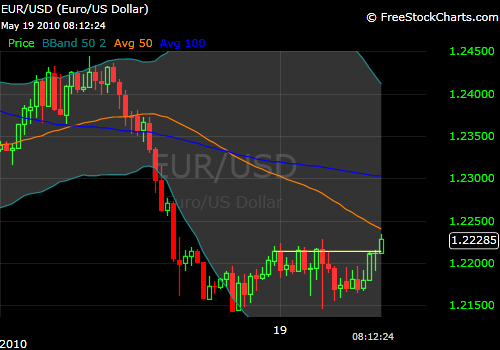

The strength in the dollar yesterday may have been a “flight to safety” risk aversion trade-some irony there in that CNBC style explanation.

Market straight down, dollar straight up-wow.

The German antics with banning short sales, shorts on Collateralized Debt Swaps and on 10 leading German financial institutions.

See if you can guess what time yesterday the Merkelians made this announcement. Crashola from then…this is a major currency with this kind of volatility…ain’t supposed to be like that.

So…what else? Dollar-gold

This is a daily chart going back to July when the market began phase two of its rocket up just when everyone was waiting for the right shoulder to break and stocks to go back to the March 6th, 2009 lows (me in the front row). The dollar tanked, the market soared..look at gold..went right with the market..look at gold with the market tanking and the dollar skyrocketing…just for now, for a while, the pattern has changed from what it was.

Yesterday all 23 of IBD’s indexes were negative.

- The NYSE, the NASDAQ, the Dow and the Composite all had accumulation/distribution ratings of E-very, very negative.

- This while the short ratio dropped for the 12th session in a row to 9.85 –it had been almost 14 in mid-April. Shorts coming back in could be interesting. Market is sinking without help.

- Of 197 IBD, groups 3 were positive, 1 a zero, 193 minuses.

Golden infobits:

- Open interest on gold futures jumped 14k to 601,014-huge number.

- Gold remains the number index of the 23 tracked.

- Generally the XAU is overbought and ready for correction when the ratio of the xau/gld is near .22. It was .1464 at yesterday’s close.

- The normal ration of the HUI is around .51-now .3872

The gold stocks have done pretty well and especially so since the Feb 5th bottom but they are nowhere near their traditional ratios. The market is always right and the market usually returns to its’ means in its’ own good time.

If we follow a policy of buying weakness in strong areas, this might be something to keep an eye on and get some buys in place.

Wish I had a first-aid kit if that blood in the water is yours but I don’t. Check with Angela Merkel or Goldman Sachs. Both are doing God’s work and helping you is their highest priority.

Asia was red, Europe is massively so, US futures, gold too. More market mayhem.

JohnR

Goldensurveyor.com