There are various methods for us to evaluate the ‘health’ of a rally in stocks. For example, we can look at relative strength among ‘risk on’ and ‘risk off’ asset classes, we can see which sectors have lead the market higher, we can view seasonality trends, and we can also look at the bond market.

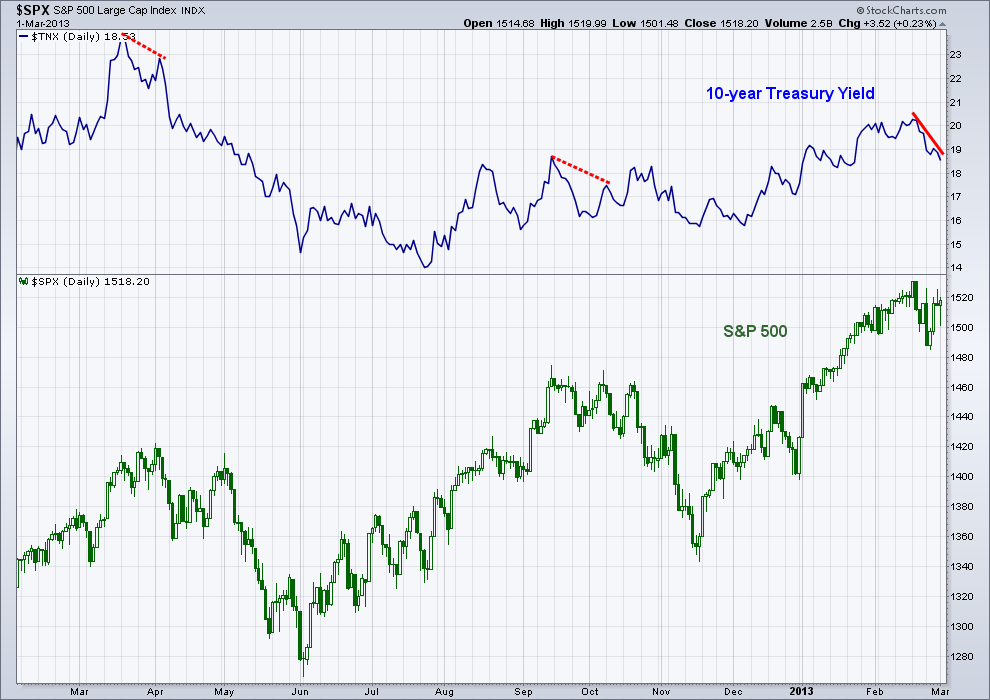

Typically we see confirmation of higher highs and lower lows in bond yields as stocks march higher. The chart below shows a great example of this from the November 2012 low. We saw stocks bottom and rise making higher highs right alongside the 10-year Treasury yield. Recently we have seen an uptick in volatility as traders learn that in fact prices can go down. Last week bulls did their best to regain the prior set highs, and they almost accomplished their goal as we finished the week just under 1520. This is great; however, Treasury yields did not have the same type of recovery. As the chart shows bond yields continued to decline, putting in a lower low while stocks were attempting to rebound.

This could throw some cold water on the equity bull’s hopes of continuing the trek higher; we need to see the divergence in bond yields correct itself for equities to have any meaningful advance from present levels. I’ve marked in red dotted lines the past two instances where we’ve seen a divergence in yield while stocks made intermediate highs. As you can see the bond traders ended up being the ‘smart money’ and stocks eventually fell in line and corrected. We’ll see if the current divergence is any different.

Disclaimer: The information contained in this article should not be construed as investment advice, research, or an offer to buy or sell securities. Everything written here is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned.

= ==

Editor’s note: Utilities, a typical defensive sector has begun to outperform recently. Read this story to find out what it could mean for stocks ahead.

Utilities: Stock Bulls Ignore This At Your Peril

The gold market rally might not be over. After all, Ben is still the Fed Chair for now.