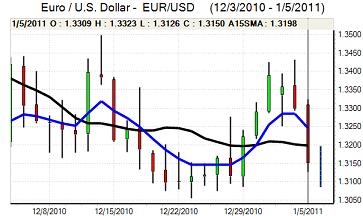

EUR/USD

The Euro drifted weaker to test support near 1.3250 against the dollar during the European session on Wednesday and then weakened sharply during New York trading.

The US economic data was the catalyst behind the sharp move with a much stronger than expected ADP employment report. There was an estimated 297,000 increase in private payrolls for December following a revised 92,000 increase the previous month. There will be some concerns that seasonal distortions may have had an important impact given that other data has not been as strong. Nevertheless, the data pushed bond yields sharply higher which also boosted the dollar.

The headline ISM report was also stronger than expected with a rise to 57.1 for December from 55.0 previously which will maintain expectations of stronger growth conditions. The employment index was, however, only just above the 50 benchmark and was not consistent with the ADP report which will maintain some degree of caution over the Friday data.

The Portuguese bond auction attracting sizeable investor interest on Wednesday, but yields were also higher which will temper market optimism. There will be a bigger test of confidence next week with a Spanish auction and underlying Euro sentiment is likely to remain very fragile. ECB comments will need to be watched very closely given the recent increase in inflation indicators.

The dollar advanced to highs near 1.3125 before consolidating close to 1.3150 with markets encountering solid Euro buying support at lower levels.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar edged higher to the 82.20 area ahead of the New York open on Wednesday and then advanced strongly following the US ADP release. There was a strong rise in US bond yields which had a direct impact in boosting the dollar against the yen.

Risk appetite was also generally firmer following the economic releases and this continued to dampen defensive demand for the Japanese currency with investors taking a more positive stance towards global growth and carry trades.

The dollar secured its biggest daily advance for three months with a rise to a peak near 83.40 before consolidation near 83.15 in Asian trading on Thursday. The Japanese Finance Ministry will certainly be content with the weaker yen trend.

Sterling

Sterling was again unable to sustain a move above 1.5620 against the dollar on Wednesday and retreated to lows near 1.5450 before finding support. Sterling was resilient on the crosses as the Euro weakened to below 0.85 for the first time in 2011.

The UK economic data was weaker than expected with a decline in the construction PMI index to below 50 for December. There were adverse weather conditions during the month which lessened the potential market impact of this release.

The services PMI index will be watched closely on Thursday and a weak reading for this report would be more important in undermining Sterling confidence. The prices component will also be watched closely and a high reading would increase underlying inflation fears and put further pressure on the Bank of England to raise interest rates. Choppy trading is likely to remain the dominant short-term feature with Sterling moving back to test resistance above 1.55 against the dollar on Thursday.

Swiss franc

The franc remained on the defensive against the Euro on Wednesday, retreating to the 1.27 level during the New York session. With the dollar also performing strongly, the franc retreated sharply to lows near 0.97 against the US currency.

Increased confidence in the global growth outlook will tend to stifle franc demand on defensive grounds, especially following upbeat US data. The Euro-zone outlook will still need to be watched closely as any renewed stresses within capital markets would trigger fresh demand for the franc. So far, Swiss growth also appears to be holding up relatively well which will tend to lessen selling pressure on the franc.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

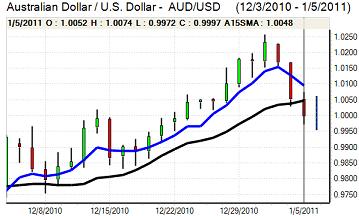

Australian dollar

The Australian dollar hovered just above parity for much of Wednesday before retreating to significantly below this level following the US economic data. There was further evidence of a shift away from commodity currencies, although the impact will tend to be mitigated by a general increase in confidence towards global growth.

The domestic economic data remained weak with the PMI services index weakening to 46.4 for December from 46.2 previously, matching weakness seen in the manufacturing report, which will tend to increase unease over the economic trends. There was also a decline in building permits according to the latest data and the Australian dollar was unable to regain parity against the US currency.