With the Nasdaq acting as weak as it is, is it reasonable to think that an avalanche of tech earnings this week will lift the tech index out of its recent doldrums? It’s possible, but not likely in the near-term as sellers continue to have the upper hand in the market. I’m in watch-and-wait mode right now. Without an edge, there’s no need to aggressive with new buys ahead of what could be a volatile earnings season.

INTEL ON TUESDAY

Dow component Intel (INTC) reports Tuesday after the close. In early September, the chipmaker lowered estimates due to “weaker than expected demand in a challenging macro-economic environment.” It also said customers were reducing inventory due partly to soft PC demand and slowing growth in emerging markets.

The Thomson Reuters consensus estimate calls for profit at Intel to fall 23% from a year ago to $0.50 a share with sales down 7% to $13.2 billion. I see no reason in owning the stock here due to hazy earnings visibility at best. The stock has been in a technical downtrend since early May and institutions continue to dump the stock. Cheap stocks are often cheap for a reason.

HIGHLIGHTS

Don’t get too pessimistic about tech earnings though, because results should be solid from Ebay (EBAY) and Google (GOOG).

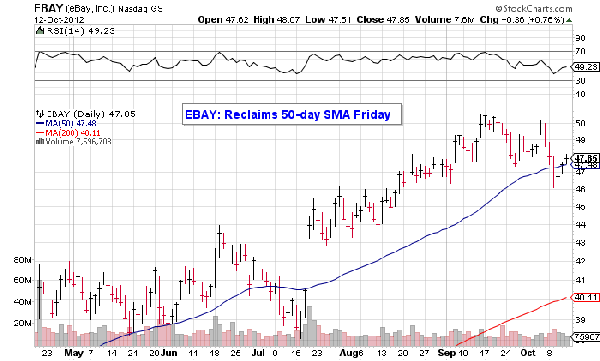

EBAY ON WEDNESDAY

EBay reports Wednesday after the close. Its PayPal unit continues to be a growth driver for the company. In the second quarter, the unit processed over $34 billion worth of transactions, up 20% from a year ago. Third-quarter profit at eBay is seen rising 15% to $0.55 a share with sales up 15% to $3.4 billion. The stock continues to hold up better than other tech names, but nibbling at the stock ahead of earnings isn’t a risk I’m willing to take.

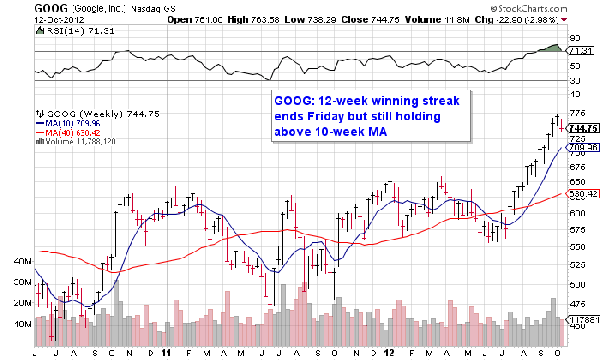

GOOGLE ON THURSDAY

Meanwhile, Google reports Thursday after the close. Profit growth is expected to slow sequentially from the second quarter, up 9% to $10.56 a share, but sales, including traffic and acquisition costs (TAC), are seen rising 58% to $11.9 billion. Google’s 12-week winning streak was snapped last week. After a huge price run in recent weeks, I wouldn’t be surprised to the stock eventually pay a visit to its 10-week moving average, currently at $710.