Watchlist: ILMN BLL ENER SEPR TIVO XLNX CHU

Stalling a little bit in my trading with three of the last four days break even. I’m using good risk management to keep losers small and avoiding catastrophic losses. In general, I have increased the percentage of my winning trades as well. Going forward, these are areas I want to work on as I have mentioned before:

1) Let my winners run longer ~ I will put my stop loss orders in and not move them. When a stock moves twenty cents (eventually want this to be more like 50 cents), I will take partial profit and exit half my position. The remaining 100 shares, I will let run until the initial profit target, usually a half or whole dollar price, with a stop loss order placed at break even in case it doesn’t hit the target.

2) Reduce my hesi-trading ~ Enter set-ups as soon as I see them. Today, I had three tickets created in my Order Management System, but did not “start” them. They went on to make over a $1.50 price move as the morning progressed. If I am not 100% sure of a set-up (but like 90% certain), I will enter only a half position to reduce my risk but to get me into the trade.

3) Stay more alert and focused ~ I have a small watchlist but everyday, I miss clear breakouts and breakdowns because of distractions and poor mental acuity. I need to deal with the distractions by being more productive during my work hours, avoiding procrastination and doing deadline driven tasks ahead of time so my plate is cleared during the morning hours for trading. I need to improve my mental fitness through eating better, exercise and reducing my caffeine intake.

4) Better entries, tighter stops and selective flipping ~ On some of my trades I am chasing a bit rather than waiting for a pullback or bounce-up – with these I often get stopped out because I enter a position and then they retrace to the area where I should of waited for entry. On other occasions, I’m giving too much breathing room in my stops; I’m shorting at a clear resistance area, and if it busts above that area, it’s likely a break out. With these, it would be better to make my stops tighter, and on real price pivots, as in my trading plan, I should flip the stock.

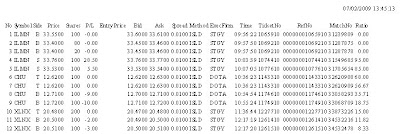

Here are my trades today:

| Tick | Shares | Side | Gross | Fee | Net | Set-Up | Actual |

| ILMN | 200 | L | 34 | -2.85 | 31.15 | ORH-BO | ORH-BO |

| CHU | 200 | S | -19 | -3.74 | -22.74 | ORL-BD | Bot Bou |

| XLNX | 200 | S | -5 | -2.76 | -7.76 | Top Fade | ORH-BO |

| $ 0.65 |