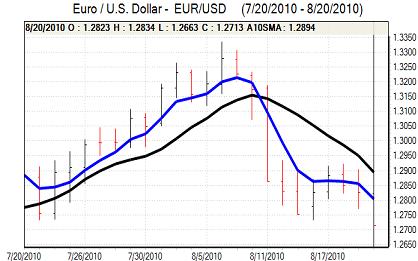

EUR/USD

The Euro was unable to secure any significant buying support in European trading on Friday and, after hitting selling pressure close to the 1.2830, there was renewed selling pressure during the session

The currency was undermined initially by persistent weakness in risk appetite as concerns over the global economy increased following the raft of weak US data on Thursday. The downbeat Euro mood intensified later in Europe after comments by the Bundesbank Head. Weber stated that the ECB should help European banks through the year-end period in order to avoid the re-emergence of liquidity tensions The comments had the effect of undermining confidence in the Euro-zone financial sector as a whole and there was a renewed widening of European credit-default swaps.

During August, the Euro has consistently weakened when swaps have widened, especially as it has triggered renewed fears over sovereign credit ratings and the Euro weakened to test support levels below 1.2750. A break of technical support triggered stop-loss selling and the Euro dipped sharply to 5-week lows around 1.2670 before stabilising just above the 1.27 level

There will be unease over the US GDP and housing-related data released over the forthcoming week and this will tend to reinforce the mood of caution towards risk. The latest speculative positioning data also recorded an increase in short dollar positions which may cushion the US currency from any renewed selling pressure give the possibility of short covering.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The yen maintained a firm tone in Europe on Friday, driven primarily by a renewed deterioration in risk appetite as global growth fears increased. The dollar again tested support levels near 85 against the Japanese currency while the Euro weakened to lows near 108.

There was hesitation over selling the dollar aggressively, especially with speculation that the Bank of Japan could announce additional measures over the weekend or surprise the market with intervention ahead of the Asian open on Monday. In this environment, the dollar strengthened to the 85.80 area later in the US session despite an underlying lack of confidence in the currency.

Sterling

Sterling moves were dominated by global trends on Friday and the UK currency suffered a further test of support levels against the dollar. The UK currency moves have been influenced consistently by trends in risk appetite and a lack of confidence in the global economy has undermined Sterling. With defensive dollar demand, the UK lost support close to 1.55 and weakened to 3-week lows around 1.5470 before finding some degree of support.

Renewed doubts over the Euro-zone economy is likely to have a mixed impact on the Euro. Sterling will be vulnerable if risk appetite weakens, but there should also be some protection based on optimism that the UK is making headway in tackling the structural weaknesses. A lack of confidence in the Euro also provided support and it strengthened to re-test resistance levels beyond 0.82 during Friday.

Swiss franc

The Swiss franc gained strong support on Friday as confidence in the global economy deteriorated and there was fresh defensive demand for the franc. There were notable stresses in the Euro-zone cross as the Euro weakened to a seven-week low near 1.3140 against the franc and was close to record highs seen at the beginning of July.

Cross-related franc strength prevented the dollar making much headway, but it did rally to the 1.0350 region.

Renewed fears over the Euro-zone economy and a general lack of confidence in the global economy will continue to provide underlying support for the franc in the near term, especially if fears over liquidity stresses within the Euro banking sector increase.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

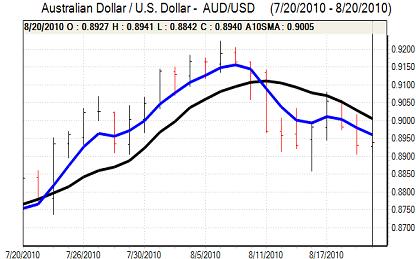

Australian dollar

The Australian dollar was undermined by a renewed deterioration in risk appetite during Friday as equity markets weakened and there were persistent doubts over the global economy.

There was also some caution ahead of the Australian General election as opinion polls pointed to a close result and the Australian dollar weakened to lows below 0.89 against the US currency. A hung parliament could trigger initial selling pressure on the currency, although it is likely to be international risk conditions that dominate.