Traders follow a set of rules and then live by them to stay disciplined and consistent. I pride myself on my routine and rules that I live and trade by. While I rarely miss a spin class, I’ve recently violated one of my steadfast rules trying to catch a top in silver.

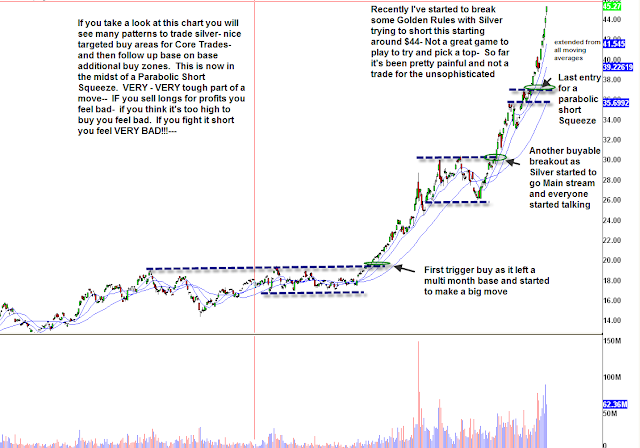

Recently I’ve been fighting this trend in silver after booking profits from riding it previously. I’ve been trying to catch the home run short in silver, but all the while the other team is melting the precious metal higher with singles and doubles.

Recently silver rise has started to go parabolic. It’s a move that makes everyone feel frustrated, except for those ardent believers in silver and skyrocketing precious metal prices.

If you’re long and sell it to book profits, it goes higher and you are then frustrated to miss out. If you’re looking to enter but being responsible waiting for a pull back, you are frustrated because you missed the boat entirely. If you start trying to get cute by shorting it, thinking it’s come way too far too fast, you aren’t just frustrated, you’re feeling some pain!

I haven’t seen a move like this since the Internet bubble of 1999. Those who shorted early ran out of money before they were right… I’ve been trading around my silver short for a few days now, not in much size but feeling the losses nonetheless.

Trying to blindly pick a top breaks my rules and I will let you know when I see a more defined topping pattern or reversal which we have not yet.

Last time I did this was last November with Las Vegas Sands Corp. (LVS) after trading it at various points from $17 to $30, I stayed away and next things I knew it was at $49. Due my frustration over missing out on the long extension, I thought I would try to be cure and short it. I got stopped out of most of my size at $54 on a Friday at 2:30, then at 3:30 it broke and went from $54.50 down to $50 and then within weeks down to low $40’s. All you had to do is wait for the Reversal pattern on volume instead of trying to be cute and “catch a top”. Some of you who have been with us for a while may remember that trade.

So, foolhardy or not, I will continue to watch silver closely in anticipation of the big short. During this melt-up I will stay in light size and add on a more definitive reversal pattern. But it’s been a long week…

*DISCLOSURE: Short SLV

This material is being provided to you for educational purposes only. No information presented constitutes a recommendation by T3 LIVE or its affiliates to buy, sell or hold any security, financial product or instrument discussed therein or to engage in any specific investment strategy. The content neither is, nor should be construed as, an offer, or a solicitation of an offer, to buy, sell, or hold any securities. You are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs. Visit the T3Live Homepage, Virtual Trading Floor, and Learn More About Us.