When is the last time you turned $100,000 into $100Bn?

How about $100M? $10M? No? Why is that, do you think? It’s because, by the time you invest in a public company, the original investors have already made 10 times, 100 times, even 1,000 times their original investment. This is why Investment Banks but a lot more effort into competing to win the next big IPO than they do into deciding what stock to buy. Don’t get me wrong, you can make a very nice return on stocks – but never the kind of returns you can get from backing a winning start-up.

Yes, 9 out of 10 small businesses fail and not to many of those become huge winners but that is exactly why I have such high hopes – as we discussed in our original Build a Berkshire post – for our being able to beat those odds. Just like any good Venture Capital operation – we are chock full of experts in various fields within our group, we have the makings of the kind of team that can identify and nurture good investment opportunities and help turn them into great companies.

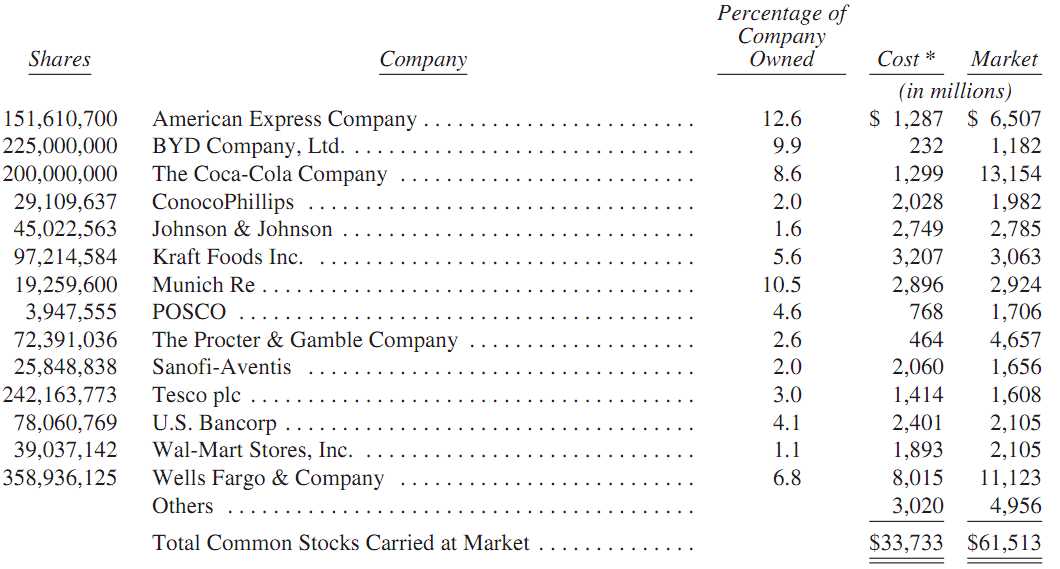

My one criticism of Warren Buffett is that he tends to hold his companies too long. Warren is not willing to cash out and move on to the next thing. Part of that is legitimate – when you are cashing out $13Bn worth of KO stock – what exactly is a better place to put your money? But, as we have pretty clearly demonstrated over the past couple of months at PSW – Cash is indeed King if you time it right and we’re not in danger of running into Warren Buffett’s problem in the near future.

What we need to do is think about how best to deploy cash over the long, medium and short hauls, building the kind of company that can seize market opportunities when they present themselves while, at the same time, building a foundation that will stand the test of time and generate the cash flows for years and decades to come.

While we have had some very good discussions regarding structure, etc, it is unfortunate that current securities regulations do not allow us to do what Warren Buffett did in 1962, which was borrow money from people he knew – getting investors big and small…