“Build a better mousetrap, and the World will beat a path to your door.”

Of course we know that’s not entirely true – even if you build a better mousetrap, if you don’t secure the patents and fail to develop adequate production, marketing and distribution systems or fail to adequately control your costs – the World can be a very unforgiving place.

Even if you do all those things right, you’re only as good as your last quarter in the even more unforgiving stock market as the good people at RIMM can surely attest. While there is a lot of money to be made betting on the daily and monthly swings of the market – Warren Buffett has shown us that buy and hold still has a place in this World and, in fact, outperforms all the noise over time.

I’m not going to make this a post about Berkhshire – you can read my February post “Warren Buffett’s Secret to Making 100% a Year” and you’ll quickly get the gist of how much I like Warren and his company. Since 1965, each Dollar invested originally in Berkshire stock has grown 490,409% vs 6,262% for the S&P 500 – an outperformance of 77 TIMES in 45 years – average more than 2x the S&P average each year and then left to the miracles of compounding!

It all boils down to 2 key elements – Cash Flow and PATIENT Money. In Buffett’s third year, he underperformed the S&P by 20% and as recently as 2009 (by 6.7%) and 2010 (2.1%) and this year (about 10% so far) and that’s in large part because Buffett has been deploying his cash to take long-term positions – despite the fact that he’s 81. Why? Because that’s the opportunity of the moment!

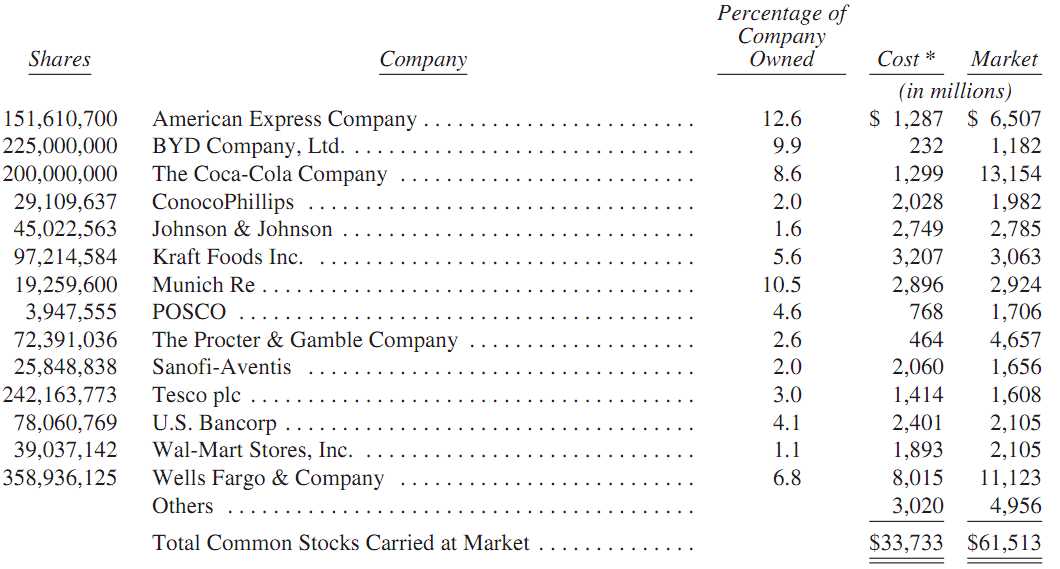

You may think Berkshire is diversified but it really isn’t. As of last year, 45% of their money was in Financials and 43% in Consumer Staples – Warren Buffett would fail Jim Cramer’s “are you diversified” test!

You may think Berkshire is diversified but it really isn’t. As of last year, 45% of their money was in Financials and 43% in Consumer Staples – Warren Buffett would fail Jim Cramer’s “are you diversified” test!

Also, very few people realize that Buffett’s first purchase, the Berkshire Hathaway textile manufacturing company – was actually a failure – a mistake Buffett himself has said cost him roughly $200Bn had the money been put to better use at the time.

While some people may say that and you can roll your eyes, the fact is…