Last week I released a post about the groundwork for a market neutral strategy. Since then I continued my research. With this post I want to share with you some of the interesting highlights and inspire you to kick-off your own research.

As I wrote at the end of the last post: my main focus will be on improving the overall % size per trade. My goal is to have at least 0.75% per trade, before commission and slippage.

So let me share with you some of the ideas I have and how those materialized:

Improve Ranking

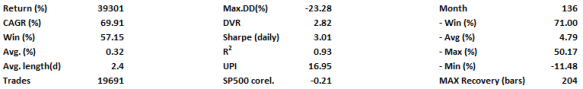

In last week’s research I looked at how stocks have been mean reverting using an intermediate to longer-term indicator, e.g. RSI(14) or RSI(10) or ROC(252). My assumption to test: the mean-reversion effect for stocks is stronger when they are oversold on a shorter as well as intermediate term time-frame. So Let’s add a second dimension to the ranking algo. I created a combination ranking of RSI(10) and DV2 . DV2 is an indicator from David Varadi. DV2 is looking at the past two day move of High, Low, Close in relation to the past 252 days. Hence it’s a significantly better RSI(2).

The test is done on a survivorship free SP500 index (link) . Data not adjusted for cash dividends, no commission / slippage considered.

Absolute returns have significantly increased showing the effectiveness of the addition. Unfortunately return per trades remain about the same, still to low for me.

Prolong the Trade

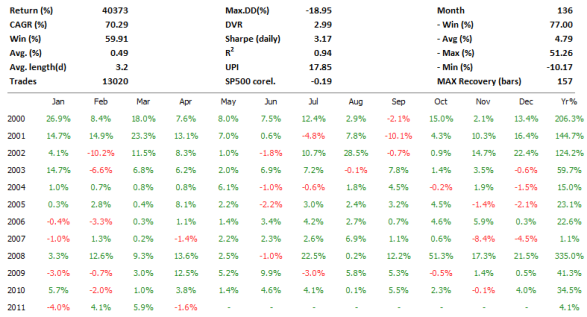

Average trade size remains an issue. An idea to further improve the strategy is to prolong the time in the trade. In above’s test a trade is entered when the stock is among the top 5 (short) or bottom 5 (long) according to the combination ranking. So Let’s extend that rule to

– Enter Long: when among bottom 5 stocks, Exit Long: when NOT within bottom 50 anymore.

– Enter Short: when among top 5 stocks, Exit Long: when NOT within top 50 anymore.

As you can see the Avg. length per trade has changed from 2.4 to 3.2 days and so has the avg. return per trade from 0.32% to 0.49%.

Further Improvements

Now you have to do your own homework. Here is some more food for thought:

- All tests have been done with an equal position sizing approach: 10% of equity per stock. To trade the strategy in a true market neutral approach one would need to adjust the position size according to a stocks volatility.

- Furthermore you might want to think about stocks that mean revert better than others.

I’m going to continue my research.

Related posts: