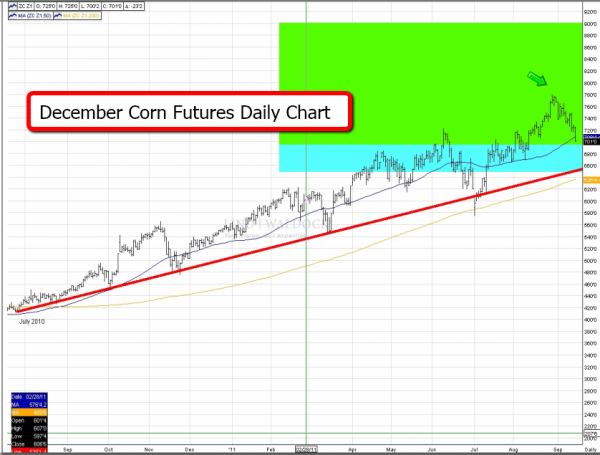

Agricultural markets can offer some interesting opportunities for a trader during growing season, and this year has been no exception. Going back to July 2010, corn was trading around $4.20 a bushel. Since that time, this market has been in a bullish trend, as less-than-ideal growing conditions have created concerns yields won’t be able to meet demand. In recent days, some bearishness has been creeping into the market. Corn prices have fallen from their 2011 peak in August above $7.80 are down about 2.6 percent this month, but still remain near $7. If you are bullish this market but are concerned about these short-term market swings, you might consider an options strategy I find compelling right now.

First, let’s talk about fundamentals a bit. Looking at the big picture, I think the bull market in corn will continue. There are supply concerns, and possible rationing. The last several USDA corn crop estimates have been revised lower. In July, the USDA had predicted the second-largest crop since WWII. Heading into August, the forecast was revised lower to about 153 bushels an acre, then in September, it was revised lower again to about 148 bushels.

The growing season this year has had some challenges. Generally in the key North American growing regions, we saw a cool, wet spring, followed in parts of the Midwest, wind damage, then strong heat. Now, the market is talking about the potential for an early frost that could do damage heading into harvest. I think we might see the next USDA numbers revised even lower for the crop.

In addition, continued U.S. dollar weakness should support commodities priced in dollars (such as corn), and Chinese demand for corn is expected to stay strong.

From a technical point of view, in the near-term, the market is coming down and just starting to violate the 50-day moving average. My trade idea for this market contemplates holding above 200-day moving average at about $6.38, with the idea corn will rebound toward $8 in the next two months. Details of the trade follow, with prices quoted as of the close of trade September 15, 2011 (subject to change.) The possible costs and profit/loss scenarios do not include commissions and any other trading costs you may have.

- Buy one December corn $7.00 call for 41 cents

- Sell one December corn $6.50 put for 17 cents

- Sell two December $8.00 calls for 11c each, or 22c total

These options expire November 25, 2011. Let’s see how the costs of this trade breaks down. You would pay 41 cents in premium for the option purchased ($2,050) and you would collect 39 cents in option premium for the options sold ($1,950). The goal is to see December corn at expiration priced between $7 and $9. The “sweet spot” is $8, and if the market is trading at this price at expiration, this ratio spread would offer you a potential profit of $5,000.

If December corn is above $6.50 but below $7.00, you would lose (based on the above numbers) $100. You have unlimited risk on one naked $6.50 put and on one naked $8.00 call. (Break-even on the $8.00 call is $9.00.) However, the market cannot be in two places at once—meaning below $6.50 or above $8.00.

This position does require a performance bond (margin). SPAN margin is approximately $1,500 for this package trade. If you were to buy an outright corn futures contract, your margin would be $2,463. Please remember that margins are subject to change without notice at any time. But you can see how you the options strategy offers the benefit of a lower upfront cost than the outright futures position.

Keep in mind, you don’t have to hold this trade until expiration. You can adjust your positions before then. Options strategies such as this one aren’t right for every investor, and involve unique risks. It’s important you understand all the risks involved.

Please feel free to call me to discuss this strategy in further detail, or with other questions you might have about the markets.

Michael Sabo is a Senior Market Strategist with MF Global. He can be reached at 800-798-7671 or via email at msabo@mfglobal.com.

Futures trading involves the substantial risk of loss and is not suitable for all investors. Past performance is not necessarily indicative of future trading results. Trading advice is based on information taken from trade and statistical services and other sources which MF Global believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder.

© 2011 MF Global Holdings Ltd. All Rights Reserved. Futures Brokers, Commodity Brokers and Online Futures Trading. 141 W. Jackson Blvd. Chicago IL 60604. 800-445-2000.