Shares of the industrial gases supplier, Praxair (PX), have had a volatile start to 2014, but are up 0.90% year to date. Praxair trades at a P/E ratio of 20.27x (2015 estimates), 5.7% revenue growth, 2% dividend, and has an average analyst price target of $145 (11.07% above the current share price). Deutsche Bank maintained a buy rating with a $146 price target recently. On Wednesday, April 30, the company announced that they would raise argon prices up to 20% due to strong demand exceeding supply, which required investments in production capacity upgrades and additional distribution resources. These changes will take place on Thursday, May 15.

Unusual Options Activity

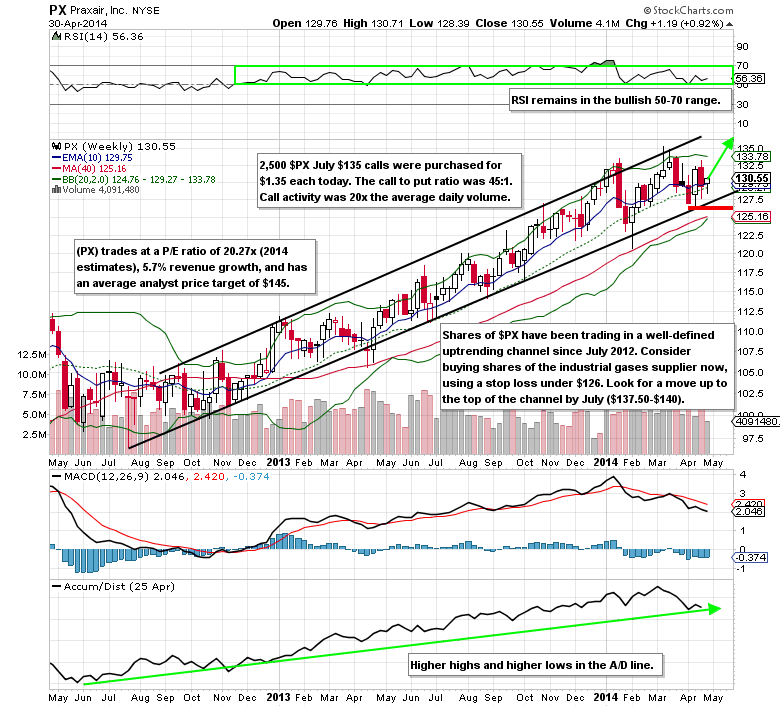

On that same day someone purchased 2,500 July $135 calls for $1.35 each ($337,500 worth of risk). Also, more than 500 June $135 calls were bought for $0.85-$0.95 each later in the day. The call to put ratio was 45:1. Call activity was 20 times the average daily volume.

Technical Analysis

Shares of Praxair have been trading in a well-defined uptrending channel since July 2012. The stock retested the bottom of the channel in early April and is now starting to move higher. A stop loss can be placed under $126 on a long stock position. Look for a move up to the top of the channel by July ($137.50-$140).

Praxair Options Trade Idea

Buy the July $135 call for $1.50 or better

Stop loss- None

First upside target- $3.00

Second upside target- $5.00

Disclosure: I’m long the July $135 calls for $1.45 each.

= = =

Mitchell’s Free Trade of the Day featuring QUALCOMM (QCOM)