By: Zev Spiro

While the big picture for the major indices still appears healthy, the markets feel slightly heavy at these levels with many individual names experiencing selling yesterday. A minor and healthy pull back in the overall markets may provide a buying opportunity at support in names that have recently broken out. Below is a chart of the SPDR S&P 500 Trust (SPY) highlighting key areas that should provide support in the event of a pull back. Additionally, below is a trade idea in Huntsman Corporation (HUN), which broke out yesterday on heavy volume and was relatively strong versus the S&P 500.

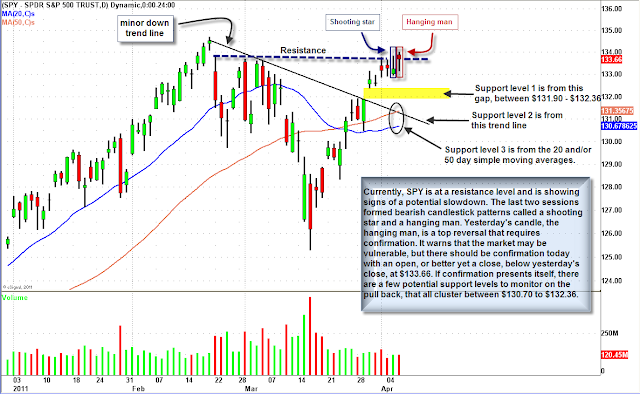

Chart 1: The daily chart of SPY below outlines bearish candlestick patterns that recently formed at resistance, warning of a short term pull back, only if confirmed by today’s action. In addition, a few short term support levels are illustrated that all cluster between $130.70 to $132.36.

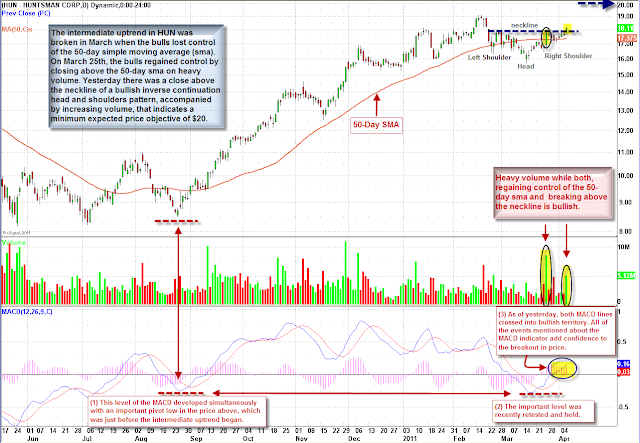

Chart 2: The intermediate uptrend in HUN was broken in March when the bulls lost control of the 50-day simple moving average (sma). On March 25th, the bulls regained control by closing above the 50-day sma on heavy volume. Yesterday there was a breakout and close above the neckline of a bullish inverse head and shoulders pattern accompanied by heavy volume. Target: minimum expected price objective is $20, obtained by measuring the height of the pattern. Protective Stops: conservative: activate on a close below the 50-day sma, currently $17.37, aggressive: confirmed move below the neckline, which is around $17.75-$18.

HAVE A GREAT WEEKEND!!

If you are interested in receiving Zev Spiro’s market letter, please email zevspiro@oripsllc.com subject “T3”

*DISCLOSURE: Long HUN

This material is being provided to you for educational purposes only. No information presented constitutes a recommendation by T3 LIVE or its affiliates to buy, sell or hold any security, financial product or instrument discussed therein or to engage in any specific investment strategy. The content neither is, nor should be construed as, an offer, or a solicitation of an offer, to buy, sell, or hold any securities. You are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs. Visit the T3Live Homepage, Virtual Trading Floor, and Learn More About Us.