It’s one of the most difficult concepts that traditional investors have to grapple with when first discovering the strategy of selling options: When selling puts, the market doesn’t necessarily have to go up – it just has to NOT go way down.

Consequently, when selling calls, the market does not necessarily have to move lower. It only has to NOT move quickly and substantially higher. Thus, as a call seller, you are not necessarily seeking markets that are going to move lower. You are only seeking markets that don’t have a good reason to move substantially higher.

It’s a subtle but important difference.

In searching for such a market, one may want to consider the current plight of Wheat.

March 10th’s USDA Supply/Demand report for wheat revealed what was a surprise to few: The world is awash in wheat stocks and they’re not going away anytime soon.

US 2009/10 Ending stocks were raised again to 1.001 Billion bushels (that’s with a “B”), their highest levels in more than 20 years. This is an astounding number, considering ending stocks stood at just 306 million bushels only 2 years ago.

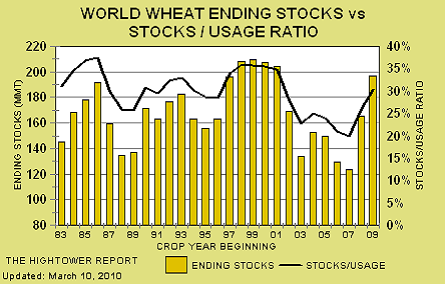

World wheat ending stocks bumped up as well to 196.77 million tones. Global stocks to usage surged by over 50% of 2007/08 levels.

Global Ending stocks for 2009/10 are at levels not seen since 2001.

Wheat production suffered during the 07/08 crop year due to weather problems in several key producing countries. The shortages carried over into 08/09 which helped support prices. However, 2009 saw European, Australian and North American production all come back online in force – producing the overstock we now have.

While wheat is not as vulnerable to recession-led demand destruction as more industrial based commodities, the supply overhang should keep pressure on wheat prices through the US summer months.

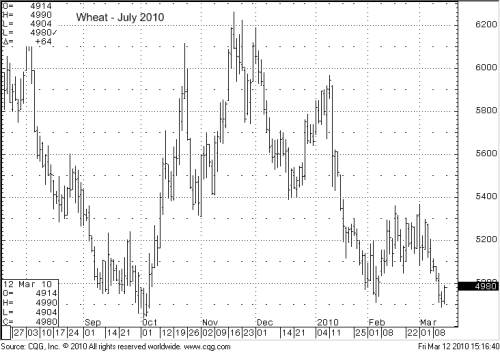

Wheat prices can still rally as the Northern hemisphere Spring can bring weather concerns in both Europe and North America. In addition, wheat is bumping along what looks to be a bottoming range on both daily and weekly charts. However, bull markets need fundamental fuel to sustain them. The burdensome supply in this market should make any sudden price rallies short lived as they will almost certainly be technical or speculative in nature.

We would look to sell another round of deep out-of-the-money wheat calls on a 20-30 cent rally over the next 30-45 days.

Fundamentally weak markets don’t always have to move down in price. However, they face a lot of headwind if they try to move higher. These kinds of markets are your candidates if you want to be a call seller.

To learn more about selling options in the commodities markets, feel free to visit us on the web at www.OptionSellers.com. A complimentary Option Seller Information Pack is available to qualified investors.

***The information in this article has been carefully compiled from sources believed to be reliable, but it’s accuracy is not guaranteed. Use it at your own risk. There is risk of loss in all trading. Past performance is not necessarily indicative of future results. Traders should read The Option Disclosure Statement before trading options and should understand the risks in option trading, including the fact that any time an option is sold, there is an unlimited risk of loss, and when an option is purchased, the entire premium is at risk. In addition, any time an option is purchased or sold, transaction costs including brokerage and exchange fees are at risk. No representation is made that any account is likely to achieve profits or losses similar to those shown, or in any amount. An account may experience different results depending on factors such as timing of trades and account size. Before trading, one should be aware that with the potential for profits, there is also potential for losses, which may be very large. All opinions expressed are current opinions and are subject to change without notice.