In a day when the average stock fell more than 1%, shares of Burger King Worldwide (BKW) rallied more than 6% on 2.5x the average daily volume. The stock gapped higher after RBC Capital upgraded the stock to outperform and raised their price target to $38 from $30. They see EPS upside from the Tim Hortons (THI) merger, international growth, and returning cash to shareholders. While this is bullish, just two days prior Goldman Sachs (GS) initiated the stock with a buy rating and a $39 price target.

The Set Up

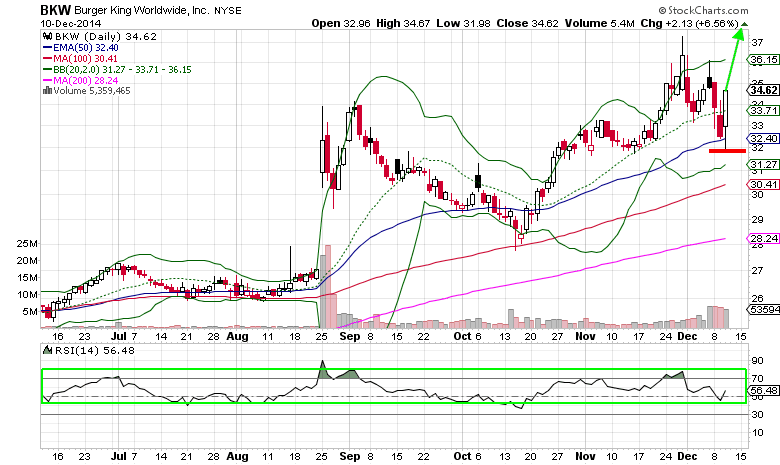

Looking at the six-month daily chart above, you can see Burger King shares printed a bullish engulfing pattern on the successful test of the 50-day exponential moving average. This sets up for a retest of the November highs of $37.30 and likely to a move to the higher $30’s in the next few weeks. The RSI is also near the bottom of the bullish 40-80 range. A stop loss on a long stock position can be placed under December 10th’s intra-day low of $31.98 to effectively manage risk.

Along with the recent bullish support from analysts, Bill Ackman’s Pershing Square has BKW shares as its 4th largest holding. Tiger Global Management owns more than 7M shares, making it their 15th biggest position.

The Trade

Burger King Worldwide Options

- Buy the Jan 2015 $34/$37 call spread for a $1.20 debit or better

- (Buy the Jan 2015 $34 call and sell the Jan 2015 $37 call, all in one trade)

- Stop loss- None

- 1st upside target- $2.00

- 2nd upside target- $2.95

#####

For Mitchell’s Smart Money Report for unusual options activity featuring FireEye (FEYE), please click here.