By: Zev Spiro

Despite negative divergences in several indicators, the major markets are continuing their bullish trends. It is wise not to fight the trend, although, tight trail stops should be used while proceeding with caution. In addition, one may hedge by shorting names that broke major up trends and/or have been in distribution patterns that triggered. With that in mind, here is a long idea in Ceradyne, Inc. (CRDN) and a short for Con-Way, Inc. (CNW).

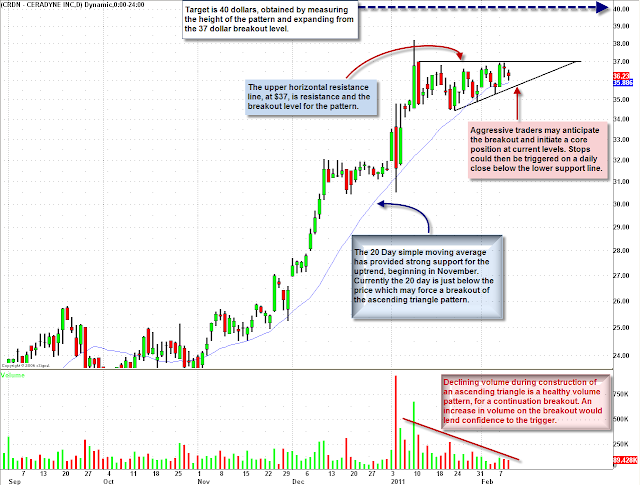

Chart 1: A bullish ascending triangle has been forming in CRDN, which will trigger if there is a daily close above 37 dollars. The 20-day Simple Moving Average has provided strong support for the uptrend, beginning in November. Currently, that moving average is directly below the price and may place upside pressure on the price, triggering a breakout of the pattern. Aggressive traders may anticipate the breakout and initiate a core position at current levels, thereby, increasing the r/r of the trade. Stops for the aggressive entry would be triggered on a close below the lower support line.

It is important to note that CRDN is a thin issue, therefore, be cognizant of prices and expect whipsaw. Trigger: daily close above $37. Target: $40 is the minimum expected price objective based on the pattern. Protective Stop: Confirmed move back below $37.

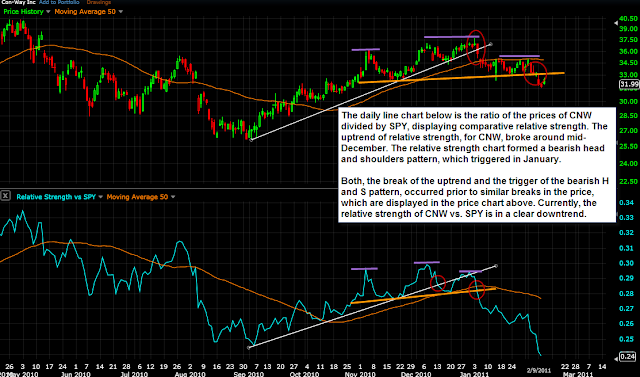

CNW is relatively weak versus the S&P 500. On February 7th, there was a strong sell-signal that was triggered by the simultaneous break of the 200-day sma and the neckline of a bearish head and shoulders pattern. Currently, there is an opportunity to short the retest, of the neckline and 200 day sma.

Chart 2: Illustrates the break of the uptrend in comparative relative strength of CNW versus SPY.

Chart 3: This daily chart of CNW highlights the recent sell-signal, which was triggered by a break of the neckline and violation of the 200 day sma. In addition, Volume, RSI and the OBV are used to support and confirm the bearish evidence. One may initiate a short position, at current levels, versus the 200 day and neckline. Target: $28. Protective Stop: confirmed move back above the neckline. Trail Stop: a minor downtrend line may be used, which could be drawn by connecting the head to the right shoulder and extending.

UPDATE:

LULU (Market Letter 2/2/11) – $82 was the minimum expected price objective. As per my comments, I sold most of the position near $82 and will continuously trail a stop to each previous day’s low.

***Note: I often mention Confirmation needing to be present for a valid breakout, or stop, to trigger. The following link is to an article titled “For Traders Only: A Guide to Confirmation” that I wrote for Minyanville Media, Inc, which may be used as a guide:

http://www.minyanville.com/businessmarkets/articles/stock-market-confirmation-percentage-confirmation-time/1/14/2011/id/32204

If you are interested in receiving Zev Spiro’s market letter, please email zevspiro@oripsllc.com subject “T3”

*DISCLOSURE: Long CRDN, CNW, SPY

This material is being provided to you for educational purposes only. No information presented constitutes a recommendation by T3 LIVE or its affiliates to buy, sell or hold any security, financial product or instrument discussed therein or to engage in any specific investment strategy. The content neither is, nor should be construed as, an offer, or a solicitation of an offer, to buy, sell, or hold any securities. You are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs. Visit the T3Live Homepage, Virtual Trading Floor, and Learn More About Us.