Shares of the home improvement retailer, Home Depot (HD), currently trades at a forward P/E ratio of 17.44x and a forward PEG ratio of just 0.96x. Revenue is expected to grow revenue by 4.9% for the year. The median Wall Street price target is $86, or 11.28% above the current share price. For the spring, Home Depot is will hire 80,000 seasonal employees. They’re expected to report Q4 earnings on Tuesday, February 25.

Bullish Options Activity

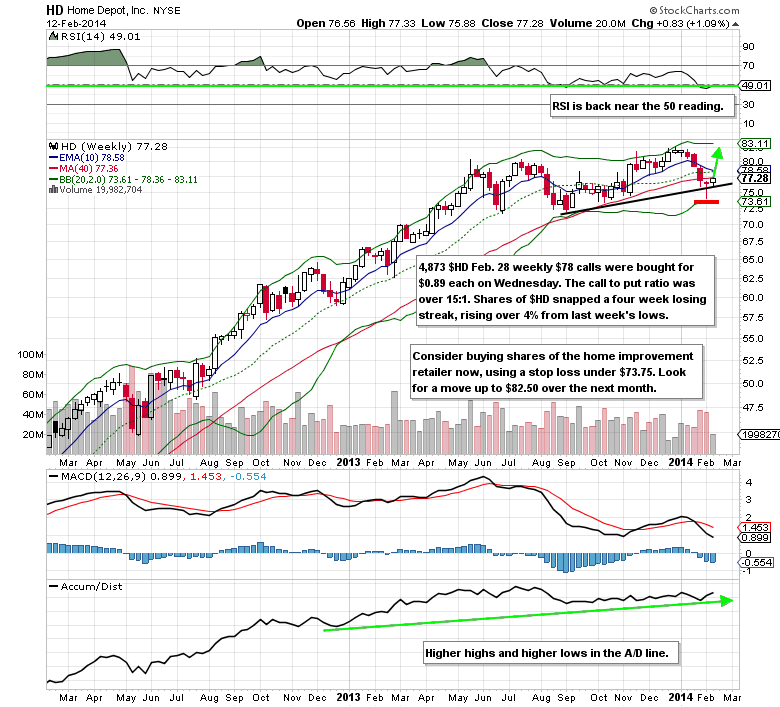

On Monday, February 10, someone purchased 6,000 March 2014 $75 calls for $2.74 each ($1.64M). Two days later there was buyer of 4,873 Feb. 28 weekly $78 calls for $0.89 each ($433K). Note that those weekly calls expire the same week Home Depot will report Q4 earnings. Breakeven on that trade is $78.89 at options expiration. The options market is currently implying a $2.86 move, or 3.70%, in either direction through February 28th.

Technical Analysis

Shares of Home Depot snapped a four week losing streak, rising over 4% from last week’s lows. A stop loss on a bullish position can be placed under the current support level of $73.75. There is upside potential over the next month into the low $80’s.

Home Depot Options Trade Idea

Buy the Feb 28 weekly $78 call for $1.10 or better

Stop loss- None

1st upside target- $2.50

2nd upside target- $4.50

= = =

Mitchell’s Free Trade of the Day featuring Kodiak Oil & Gas (KOG)

Related Reading

TraderPlanet Journal article