The Golden Sunrise

The essential morning read for investors!

Today’s Golden Sunrise

Thursday, April 29, 2010

Hours of daily research consolidated for you

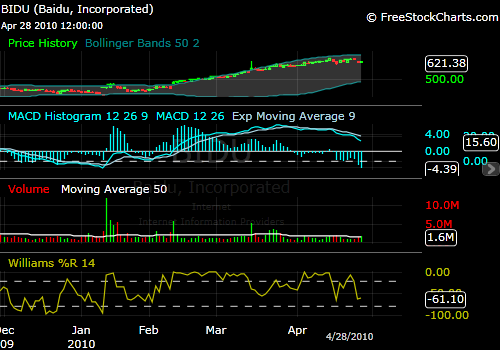

Buying BIDU today?

Chinese internet search engine Baidu reported after the close of markets yesterday and promptly jumped $80 a share. It is trading at around $720 in the pre-market, up $100 from the close. To their credit and before everything about them was covered with slime, Goldman Sachs put a $500 price tag on the stock in early February when the stock was trading at $380 following a $90 drop from $470.

Baidu (BIDU) crushed earnings with an earnings report showing $2.o2 for the quarter and sales of $189.6 million. The expectations had been $1.50/share and $180.1 million in revenue. Earnings year ago quarter were .76/sh, so the gain was over 250%.

The Revenue forecast is for $268-$274 million for the next quarter-up 50% (google apparently is leaving a lot of money on the table) vs. a forecast of $240 million. So if that growth happens, and is sustained for another 3 quarters after that, BIDU will do about $1.1 billion in revenue. If they maintain the 2.02 for the next 4 quarters, and grow the earnings at 73% which they have average for the last few years, we have them earning $14 bucks, which is a PE over 50-which means that more dramatic growth without interruption is expected.

Oh, and the market cap of $21.9 billion just went up about 15% and will mean the company is valued at 23x revenues. BIDU’s group is number 161 of the IBD 197 and, according their “suggestions”, you shouldn’t be buying it on that basis.

Another darling reported last night and things are not so cheery in Coffeeville. After peaking at 99.17, Green Mountain Coffee Roasters has had a pullback after a sharp run up. Volume was heavy yesterday at investor’s rushed into the stock before the earnings call. Some disappointment and it immediately dropped $12-13 bucks.

- Both of these charts will looking very different and after today’s close.

- The number of A rated stocks in the IBD accumulation/distribution ratings (A meanings they are being accumulated, E meaning the Little Sisters of the poor wouldn’t take the shares as a charitable donation) saw the top tier number drop from 943 to 627, a negative 33.5% in the day following the big sell-off.

- The bull ratio moved up again to 54 from 53.3 and the bears also increased from 17.4 to 18. Everybody’s still upside oriented.

- The Tuesday sell-off had such bad breadth it will take gallons of Listerine to remove the stench. The down volume on the NYSE was 1.584 billion shares, contrasted with 90 million shares rising. The Zweigian model of 9-1 being a big deal will blow fuses when confronted with this ratio.

- And another list I like to look at and ponder is the stocks up and stocks down quick glance for a view within the big picture. Yesterday, the down list had 16 (SIXTEEN) down candles with ratings over 90, 4 more over 80. Four of these entities had 99s.

- You are brave soul to be a dip buyer these next few sessions, although they will be there because that behavior has been richly rewarded.

- Late buyers to this surge will be having their stops hit.

- Shareholders with big profits from the upsurge will be raising their stops or finding their trailing stops hit if we have some more downside action.

- If the S&P doesn’t get back over 1200, those scenarios could be enacted.

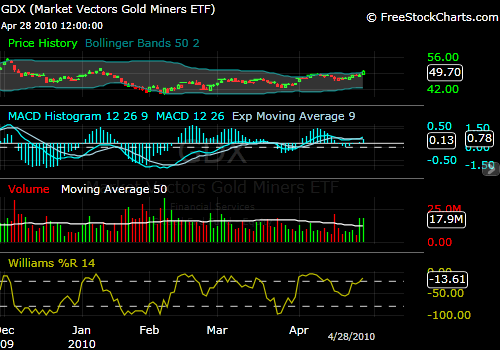

So what’s got some legs? No peeking!

v Spent over a month as the IBD #1 rated index in Oct-early Nov

v Fell all the way to last, #23, stayed there for months.

v Despite the low ranking 3 days in January it was the best performer and 1 third in 19 trading days.

v 5 No. 1s in February and one second in 19 trading days

v March had 4 number 1s, a 2, a 3 and a 4..IBD shows the top 4 each day with highlighting…using complex mathematical formulas and detailed analysis, your writer then compiles the rankings and makes a note he can refer too..

v April has 5 number 1s and two 4s.

v The last 2 days have been 1s..the top performing index. On Tuesday, it was the only positive index of 23.

v On a group basis, it has moved from 132 on Monday to 79 in two days

v The components of the index are ABX, GG, AEM, NEM, GFI, AU, ASA..4 northAmerican, 3 South African.

The GDX which is a very well-represented package of gold stocks:

Nice long base, near break out..Would love see a little pullback here but that is likely to be met with buyers…look at the last two days volume.

More on eagles:

These coins have been minted since 1986-so one can put together a “collection” of dates and have 24 without duplication. They are all valued pretty much based on gold…the smaller denominations have some year not as many were ordered and could become numismatically valuable if people begin to accumulate date sets (and some will). The smaller the denomination, the bigger the premium over the gold price…1/10 ounce eagles are about $150. A set on denominations is a way many people are going.

JohnR

Goldensurveyor.com

Golden Sunrise is the Golden Surveyor’s broad-based market and world view.

Written daily 4am-7am by markets information specialist GS John!