December 4, 2012

This trade setup is merely a random sample of the day’s trades generated by COT Signals. To track our work their and receive all of our nightly trading recommendations, click here.

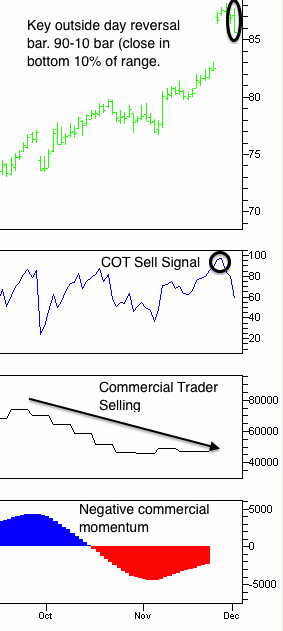

The February lean hog contract is being hit with bearish signals from every direction. Yesterday, we published a seasonal sell signal based on the recommendation of Moor Research and this morning we have a sell signal from COT Signals which, means there is considerable commercial selling. Finally, we have a technical trigger called a , “90-10.” This is described as a continuation signal in Larry Connor’s book, Street Smarts and the method was developed by Linda Raschke.

Whichever method we use to view this market, seasonally, fundamentally or, technically they all point lower. We’ll sell February lean hogs and place a protective buy stop at yesterday’s high of 87.775.

Sign Up Free For COT Signals!

ANDREW WALDOCK

866-990-0777

This information is not to be construed as an offer to sell or a solicitation or an offer to buy the commodities herein named. The factual information of this report has been obtained from sources believed to be reliable, but is not necessarily all-inclusive and is not guaranteed as to the accuracy, and is not to be construed as representation by Commodity & Derivative Adv. The risk of trading futures and options can be substantial. Each investor must consider whether this is a suitable investment. Past performance is not indicative of future results.