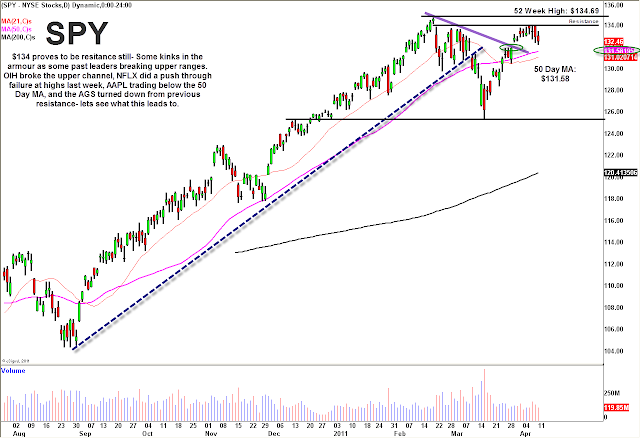

US stock futures are pointing lower Tuesday as the market has lost momentum on its climb back toward highs. The S&P is currently set to open below the gap from March 30 and into support at its 50-day moving average around 1315. After a precipitous bounce following the Japan earthquake and nuclear crisis, it is not unhealthy to see the market rest and digest like this before ultimately testing highs. However, the action over the next two days will be very important to see whether the index can hold support at the moving averages. Over the past few weeks we have seen several gaps up that have been faded, so we will see if it can work in the opposite direction.

Tech stocks have provided leadership for the market during the entire rally off March 2009 lows, but over the last few weeks the sector has been spotty. Narrowing in even more Apple Inc. (AAPL) has become a perennial market leader and often holds the key to major moves in the market. Right now, Apple is acting extremely week as it faces a myriad of hurdles. The ongoing situation with Steve Jobs–How sick is he? Will he step down for good?–has been weighing on the stock since President’s Day weekend since he announced his leave of absence. Then the earthquake has disrupted the supply chain in Japan. Most recently, a rebalancing of the indices forced selling of AAPL, which has fallen on 6 of its last 7 trading days. Apple is set to open about 1% lower again this morning as it nears big support at $326.26. At some point AAPL will present an outstanding buying opportunity.

Watch the T3Live.com Morning Call with Scott Redler and Alix Steel below.

The rest of tech is a mixed bag. Chinese Internet stocks have been among the strongest in the market, and news yesterday boosted Baidu.com, Inc. (BIDU). The Chinese search engine announced a project with Facebook to create a social networking site in China, and investors cheered the potentially lucrative venture with a big gap up. The stock traded back and forth yesterday and is set to open at yesterday’s low. BIDU will need more time to be a compelling long.

SINA Corporation (SINA) is holding up okay, but there is no need to rush here as momentum stocks are not running away right now. SINA is a candidate for a quick negative to positive trade today if the market catches a bid.

Sohu.com, Inc. (SOHU) is holding an upper flag, but some of these have been breaking. The 91-92 level is decent support, and this is another stock traders could look to buy this morning.

One of the early signs that the market may have trouble pushing quickly back to highs was the weakness in the oil service sector. The Oil Service HOLDRs (ETF) (OIH) had put in a good upper level flag and looked great technically for a breakout. However, the ETF failed the pattern and broke lower. The fund and its components have worked themselves lower, and now there could be a great opportunity to buy the dip around the moving averages, which are around 155-157 in OIH. Shouldn’t be your priority but potentially good risk-reward.

Yesterday the best trade within the T3Live.com community was Scott Redler’s call to look short silver. The best-performing precious metal had gone parabolic, opening at new highs once again, and Redler believed you could get a calculated short on the iShares Silver Trust ETF (SLV) above $40.20. The bulk of the cash flow move happened yesterday and SLV is up a bit this morning, but Redler will look to re-short more shares as long as it doesn’t break above yesterday’s high, adding on a break of yesterday’s low.

Banks remain weak and frustrating for traders, perhaps waiting on earnings from leader JP Morgan Chase & Co. (JPM) tomorrow. There is so much uncertainty in the sector with new regulations that investors have been cautious about the effect it could have on future earnings. This season’s reports will be very important, and it doesn’t look prudent to take big bets into earnings unless you are a truly long-term investor.

Alcoa Inc. (AA) met on earnings but missed on revenues last night to unofficially kick off earnings season. AA is opening lower, and although it will not be a priority for traders, seeing how the market handles the down open could be a telling sign for this earnings season. If they keep punishing this thing, it could be an ominous sign for this earnings season.

*DISCLOSURE: Scott Redler is long AAPL, POT, BAC, GLD, JPM, RBY, AUY.

This material is being provided to you for educational purposes only. No information presented constitutes a recommendation by T3 LIVE or its affiliates to buy, sell or hold any security, financial product or instrument discussed therein or to engage in any specific investment strategy. The content neither is, nor should be construed as, an offer, or a solicitation of an offer, to buy, sell, or hold any securities. You are fully responsible for any investment decisions you make. Such decisions should be based solely on your evaluation of your financial circumstances, investment objectives, risk tolerance and liquidity needs. Visit the T3Live Homepage, Virtual Trading Floor, and Learn More About Us.