Last week I wrote a post about the upcoming OPEC meeting, where the world’s top oil producing nations would be meeting to cut production and reduce the massive oil glut. This oil glut is so pervasive that some insiders claim will likely plague the world economy for the remainder of 2016 and even into mid 2017! As consumers, we all love low oil prices when we go to pay at the gas pump, heating bills, and transportation costs, but does it help us as day traders and in the even bigger picture, does it help domestic and world economies? Despite popular beliefs that high oil prices challenge world economies, this is simply not true. What most of the general/consuming public fails to realize is that the energy industry “fuels” (no pun intended) many countries’ economies throughout the world.

For this post I want to take a look at what hits home for me locally, right here in the good ol’ western hemisphere; the oil sands and the shale fields right here in the United States as well as our friends to the north in Canada. Quite often this type of oil production is referred to as “marginal non OPEC production” and many think that it’s Saudi Arabia’s goal to put these marginal producers right out of business. A fact is a fact: traditional, on land, ground drilling is far more cost effective particularly in Middle Eastern countries. The lower crude oil prices and the free fall of oil that we’ve seen in the oil market (CL) for the last 18 months has devastated these so called marginal producers of oil. The effects of this can be felt right here in the U.S. and Canada. The reality is that in order for these type of oil producers to be profitable, oil needs to be trading at higher prices.

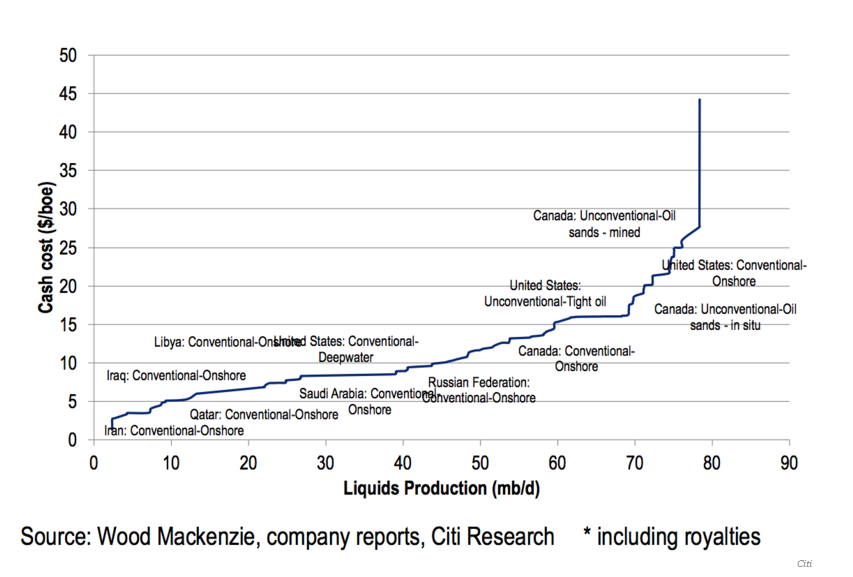

I recently read an article in Business Insider written by Myles Udland where he discussed “why the oil markets biggest problem WON’T be fixed anytime soon”. He stated a clear fact that everyone, who isn’t living under a rock knows: “The oil market is still way oversupplied” and that “prices haven’t been able to recover after falling as much as 70% for the last 15 months”. It is believed that the shale and sand producers are a culprit of this massive slide to the downside for oil, but the chart below (from Mr. Udland’s same article) that will clearly show that oil prices will need to slide much lower in order to stop shale and fracking completely.

“Cash costs, or the absolute minimum amount producers need to get for their oil just to keep their operations up and running, have declined over the last year. This is due in part to the tailwind US-based producers have gotten from the strong dollar as well as continued technological advances, thus making oil drilling cheaper and more efficient”. This is according to this very same Business Insider article. Regardless of the quote cited above, there is a certain price level that crude needs to be trading at in order for ANY alternative type of oil exploration/drilling to be more cost effective, hence, more profitable.

My theory (Heck, I’ll call it fact) is that when and if crude prices rise to higher levels, shale and oil sand production (while still cost effective) will increase and thus bolster the economies that use this form of oil production. Our million dollar question and the 800-pound gorilla in the room is that when these OPEC conglomerates meet will they halt production to drive not only the conventional oil prices higher but will it give the shale and oil sand industries the “shot in the arm” it so desperately needs? Two years ago in the Dakota’s (United States) you couldn’t touch an apartment for less than $2K a month; properties were springing up everywhere to accommodate the mad rush to the oil fields of the northern United States. These same brand new properties are now renting for as much as 70% than they were during the shale boom. If this doesn’t kill ANY local economy, I don’t know what else would; you see my point?

As traders we seek volatility, it is my opinion that higher prices would increase volatility dramatically and thus make our day trading decisions that much easier to make along with increasing profit. This so called “threat” of oil going to $10.00 a barrel IS a reality and it could happen, after all, oil traded at $10.00 – $40.00 a barrel for YEARS. With current oil prices in the “thirty’s”, price action and volatility has been marginal at best; I feel that everyone is sitting back and playing it safe until this OPEC meeting on the 17th of April is over; how will the meeting go? Will they agree to halt or slow production? Will EVERYONE agree (I doubt it)? Regardless of how this meeting goes rest assured we’ll see greater volatility in the upcoming weeks and IF prices DO go higher I think we’ll see a solid return of the troubled shale, fracking, and oil sands drilling business here in North America.

Thanks for reading,

Jason

FOR A FREE TRIAL TO THE AWARD WINNING OIL TRADING GROUP, CLICK HERE