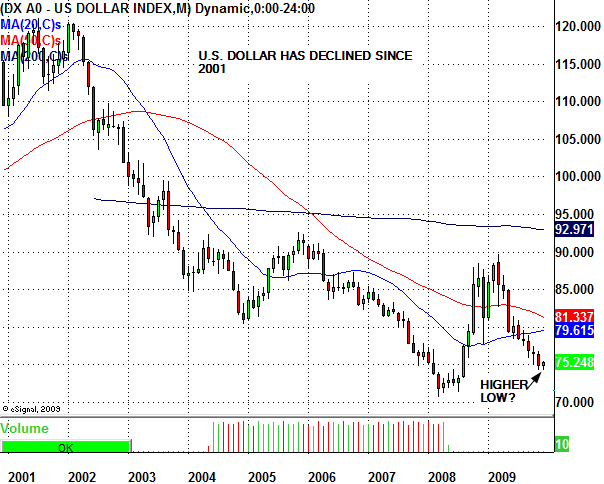

The entire stock market rally has occurred on the back of the weak U.S. Dollar. Simply put, this rally was nothing more than a re-inflation rally. Everything inflationary moved higher such as gold, copper, steal, iron ore, and agriculture. Today the dollar is catching a strong bid and the stock market is higher on the back of the U.S. government job report. Is it possible that a recovery is really underway? What will happen if the dollar begins to rally? One would think that commodities would fall or decline in price. If this is the case what would move this market higher? Where is the next catalyst for another leg higher in stocks. Use caution here as everyone gets excited over a government jobs report during the holiday season.

By IntheMoneyStocks on December 4th, 2009 10:24am Eastern Time