If there is any one concept to watch closely for signs of market direction it is the carry trades. As we are now clearly a global economy, a move in one country can affect the markets elsewhere.

A few years ago, we began telling clients about carry trades and their affect on the markets. It was an entirely new concept for some, and to this day still remains a relatively obscure idea. The U.S. dollar/Japanese yen carry trade was the most commonly referenced. This is still a driving force, but the intricacy of global carry trades has certainly increased in the past several months. We will attempt to discuss and illustrate the current movements in carry trades and how they can help decipher some of the turmoil we are witnessing in the commodities markets today.

This first thing to understand about carry trades is that they are a play on interest-rate differentials across a currency pair. For example, a large investor would borrow Japanese yen and put the money to use elsewhere, seeking a higher yield. For the purposes of this article, say the investor chose to seek returns in the U.S., specifically in sub-prime mortgage-backed bonds. In theory, this works well until the currency pair trades adversely against the investor, or the bonds fail to pay off. At this point, the investor must unwind their positions, and then convert back to yen to pay off the loan. This forces the investor to buy the yen/dollar pair. When this happens to millions of traders worldwide, buying interest pushes the yen higher. In recent cases, investors fleeing the corporate debt markets were forced into buying Japanese yen to cover their carry trades.This can be seen in the chartof the yen’s continued appreciation against the U.S. dollar for 2008.

Initially, the carry trade was most noticeable between the U.S. dollar and the Japanese yen. But as the dollar began to weaken, traders sought refuge in other currencies; most notably, the euro. This brought the euro/yen carry trade to the forefront, and for several weeks, the U.S. stock market and the euro/yen traded in tight correlation.

The next leg in this trade came when Europe started feeling the credit crunch.What had previously been viewed as a U.S.-only problem spread to the U.K., then Europe and the rest of the world. The U.S. dollar became the beneficiary of a weakening euro and British pound, as traders viewed the higher interest rates in Europe as an ability to cut more aggressively than the U.S.

More recently we have come upon a period of indecision. Central banks around the world have cut rates aggressively in an attempt to stabilize and prop up credit markets, leaving interest rates at near zero in both the U.S. and Japan. Some analysts believe that the protracted downturn in the Euro-zone could force aggressive rate policy out of the European Central Bank at its January meeting, but that has yet to be seen.

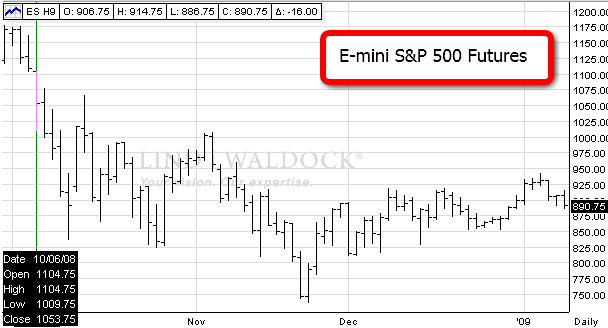

The one consistent theme to take from all this is that the yen has continued to play a pivotal role in these global markets. As investors unwind risk, the yen is being pushed higher. The early 2009 jubilance of the stock market can be seen by the recent pullback in the yen/dollar trade, as show in the chart below. The trade peaked on December 17, 2008. Should this yen/dollar cross continue to sell off from here, if could signal a return to risk in the market place, and possible near-term strength in the stock market.

Please feel free to contact us for more information about this concept or other questions you have about the markets, including specific trade strategies you can incorporate.

Greg Perlin is a Senior Market Strategist with Lind Plus, Lind-Waldock’s broker-assisted division. He can be reached at 800-437-4819 or via email at gperlin@lind-waldock.com.

Mike Marshall is a Market Strategist with Lind Plus, Lind-Waldock’s broker-assisted division. He can be reached at 800-437-4819 or via email at mmarshall@lind-waldock.com.

Past performance is not necessarily indicative of future trading results. Trading advice is based on information taken from trade and statistical services and other sources which Lind-Waldock believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder.

Futures trading involves substantial risk of loss and is not suitable for all investors. 2009 MF Global Ltd. All Rights Reserved. Futures Brokers, Commodity Brokers and Online Futures Trading. 141 West Jackson Boulevard, Suite 1400-A, Chicago, IL60604.