Caterpillar (CAT), the construction and manufacturing machinery producer, has missed Wall Street EPS estimates for the last three quarters by an average of $0.19. On top of that, earnings are expected to decline nearly 26% from last year. In a year where the S&P 500 (SPX) is up 15.5%, Caterpillar shares are severely underperforming with a decline of more than 10%. Despite all of the negatively that surrounds this company, earnings and revenue growth are expected to bounce back in 2014. The next earnings report isn’t expected to be released until Wednesday, October 23rd.

TECHNICAL TAKE ON CATERPILLAR

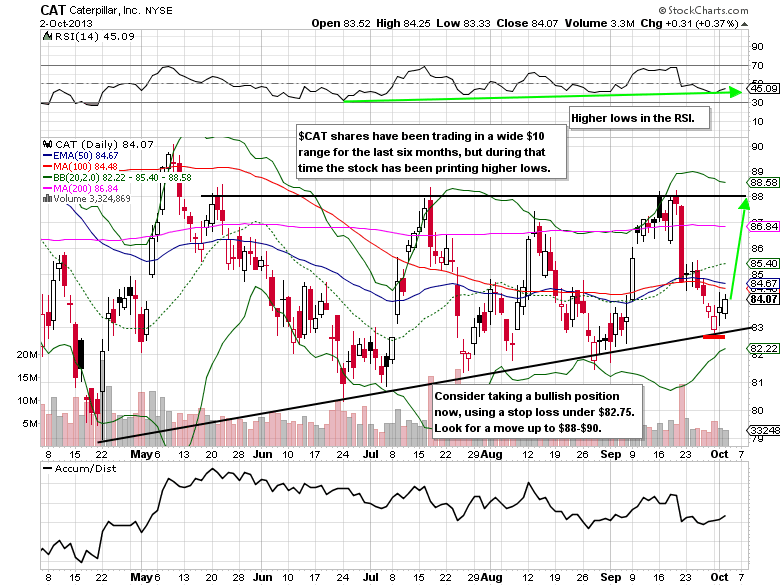

Caterpillar shares have been consolidating between $80 and $90 since April. After hitting the 2013 low of $78.94 on April 22, the stock has consistently been putting in higher lows. This once again occurred this week and is now setting up for another low risk buying opportunity. The reward/risk ratio is currently 4:1 at current levels for (CAT) bulls.

CATERPILLAR OPTIONS TRADE IDEA

Buy the CAT Oct. $85/$87.50 Call Spread for a $0.60 debit or better

(Buying the Oct. $85 Call and selling the Oct. $87.50 Call, all in one trade)

Stop loss: None

Upside target: $2.50

See another trade idea by Warren here featuring Freeport McMoran Copper and Gold

= = =

Have you seen the latest issue of the TraderPlanet Journal?

Read the cover story interview with Investor’s Business Daily’s Bill O’Neil