I love trading Silver (SLV) I shares Silver Trust.

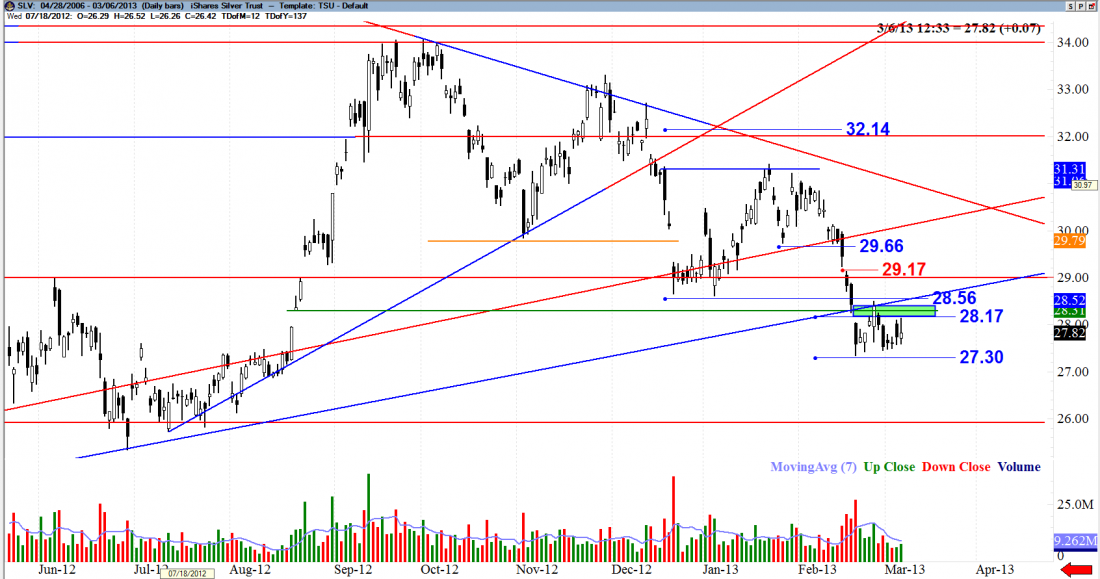

SLV is one of my favorite stocks to trade and the one on which I learned my hardest and most costly lesson, when I was learning how to trade. Meaning, yes, I bought a ton of call options at the all-time high. But that was before I knew how to trade smart. These last few months I have been waiting patiently for SLV to break out of a larger triangle. It broke out bearish and it has been one fun ride, one which I don’t believe has seen its completion.

TECHNICAL RECAP

We had an awesome and predictable bullish break in late Aug. 2012. For the past few months SLV had lower highs and lower lows (coupled with higher lows) recently in January and February. If SLV has a close below $27.30, I think the probabilities are that SLV will likely continue to the $26.00 area. We currently have declining volume, we’ve tested a broken trend line from the bottom, everything is screaming continuation but we should still wait for confirmation. The orange line at $29.79 represented confluence. Once that broke, it gave us a great signal the trend and sentiment was beginning to change.

STOP LEVEL

Risk mitigation should be easy on this trade, as the candle on March 6 (the day I’m writing this) has a long upper wick. A stop above that should justify a great entry if the SLV bearish move continues.