It seems that there is never a good time to take a couple of weeks off but this does feel like a less than opportune time to be away. The markets are stressing and straining in a variety of directions with the very real prospect of a major trend change looming. However, we have done our best to lay out our arguments and will have to trust that we have done so with sufficient clarity.

The ‘detail’ that we noticed during Friday’s abbreviated U.S. trading session was the strength in the dollar in the face of a decline in long-term bond prices. Our sense is that we will look back at Germany’s failed 10-year bund auction as marking the turning point.

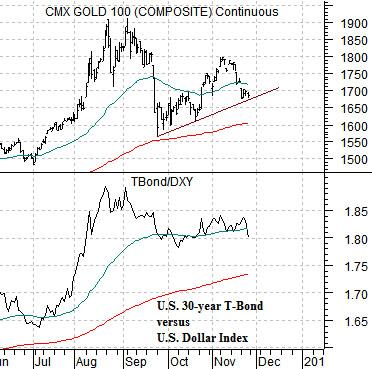

Below we show a chart of gold futures and the ratio between the price of the U.S. 30-year T-Bond futures and U.S. Dollar Index (DXY) futures.

The argument is (and has been) that the trend for gold is dead on the ratio between long-term Treasury prices and the dollar. A bullish trend for gold goes with rising bond prices as well as with a weaker dollar. A bearish gold price trend would line up with weaker bond prices and a stronger dollar.

Below is a comparison between gold futures and the Swiss franc futures.

The argument here is that gold trends very closely with the Swiss franc so as long as the franc holds support around 108 the price of gold will continue to walk up the rising trend line from early October.

Our view is that gold is the inverse to the cyclical trend. More succinctly gold is the inverse to the trend for the banking shares. Gold has been rising relative to the CRB Index ever since the early stages of the subprime crisis so our conviction is that anything that is negative for gold is bullish for the equity markets in general and the financial in particular.

Has the trend changed Even with the dip below 1.08 by the franc at the end of last week the answer has to be ‘no’. Gold is still trending somewhat higher and one day of dollar strength/bond price weakness does not make a trend. It was, of course, a step in the right direction.

When Germany received bids last week for only 65% of its 6 billion euro bund auction long-term debt prices in the Germany, the U.S., and Japan declined. This had the potential to be extremely bearish or bullish.

The bearish spin is that the contagion is now spreading to Germany with the less strong European countries facing an upward spiral in financing costs. The bullish perspective would be that frantic buying of ‘safe haven’ assets had driven German yields down to such absurd levels that it was time for the trend to turn back in the other direction.

Below is a chart of the Nikkei 225 Index and 10-year Japanese (JGB) bond futures.

The argument has been that the Nikkei and JGBs trend in opposite directions so the push above 143 by the JGBs went with the decline to marginal new lows for the equity markets. Yet… in the blink of an eye the JGBs declined back to the bottom of the trading range which has gone in recent months with the Nikkei trading closer to 9200 than 8200.

The point is that if we are facing a trend change the equity markets should respond to bond price weakness by rising. Significantly.

Below is a chart of the ratio between the Bank Index (BKX) and S&P 500 Index (SPX) and the combination of the U.S. Dollar Index (DXY) times 10-year Treasury yields (TNX).

The banks respond to a stronger dollar and to rising yields. The trend for the BKX/SPX ratio tends to go with or follow the trend for the DXY times 10-year yields. From an intermarket stand point there is nothing more positive for the banking shares than a rising dollar AND rising long-term yields. Given that this was exactly what took place at the end of last week… we thought it was also a nice step in the right direction.