In the 1999 movie ‘The Matrix’ the Morpheus character says, “You take the blue pill – the story ends, you wake up in your bed and believe whatever you want to believe. You take the red pill – you stay in Wonderland and I show you how deep the rabbit-hole goes.”

In a sense the markets appear to be offering the choice between the blue pill and the red pill. The blue pill represents- in our view- no change in trend. Take the blue pill and the cyclical rally continues led by economic growth and expansion in China, India, and Indonesia. The U.S. dollar continues to decline, the commodity currencies push higher, commodities and cyclical or risk-based asset prices continue to rise until eventually one central bank after another lifts interest rates and tightens credit conditions. In this scenario we get more of the same into the second half or, perhaps, the final quarter of next year.

We can make a good case for this outcome. Which, from our perspective, is a problem.

The red pill, on the other hand, represents the kind of outcome that PIMCO’s Bill Gross alluded to yesterday. The top of the rally for cyclical asset prices, the end of the decline for the dollar, the return to a rising trend for bond prices. In this scenario the ‘rabbit-hole’ may well be some combination of the inflation rate and long-term Treasury yields.

Keeping in mind that Bill Gross is a bond guy- perhaps THE bond guy- we acknowledge that he is facing the same choice with regard to the blue and red pills. Mr. Gross’ assertion that risk-based asset prices have reached a peak may turn out to be prophetic but there is also the possibility that his view stands out in much the same way as Alan Greenspan’s utterance of ‘irrational exuberance’ in the markets at the tail end of 1996. In other words ultimately correct albeit far too early.

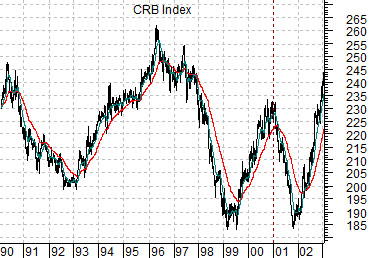

Much of our work in recent weeks has focused on the ‘red pill’ alternative. We have shown the ongoing rising trend from any number of perspectives and argued that the depth of the rabbit-hole could be tested by weakness in the Chinese equity market along with an upswing in the U.S. dollar.

The problem- the same one alluded to above- is that while the markets may ultimately be faced with a choice between the blue and red pills… we do not believe that a clear decision has been made as of yet. We can envision a path that leads to sub-2% long-term Treasury yields but we can also make a fairly persuasive case for something north of 4%.

Equity/Bond Markets

Try as we might we still have a hard time believing that the only way the equity markets can rise is through U.S. dollar weakness. The risk in attempting to conjure up a third option is a return to crisis similar to 2008.

Below we show the U.S. Dollar Index (DXY) futures and the ratio between the Morgan Stanley World ex-USA Index and the Dow Jones Industrial Index. The argument is that when the dollar declines virtually ‘every else’ does better than U.S. large caps. On the other hand when the dollar rises… U.S. large caps fare better.

With this in mind the issue is not whether equity markets will rise or fall but rather whether the DJII will rise or fall. If it outperforms with a stronger dollar by rising… then we can have a bullish outcome. If it outperforms- as it did last year- by falling at a slower pace then down the rabbit-hole we go.

Below is a chart of Johnson and Johnson. JNJ has a dividend yield of roughly 3.29%. 10-year U.S. Treasuries offer a yield close to 3.41%. If a stronger dollar leads to weaker commodity prices then yields will track lower and short of a financial markets crisis… this should serve as support.

Below is a comparison between Wal Mart (WMT) and the Shanghai Composite Index. We have argued that WMT tends to rise when the cyclical trend turns negative. The ‘cyclical trend’ usually involves some combination of Asian equities, commodity currencies, and energy and metals prices.

If the cyclical trend turns negative but WMT swings higher and if large cap names such as JNJ, Coca Cola, Pepsi, Merck, GlaxoSmithKline, and even Intel are supported by their dividend yields then the rabbit hole may be less of a hole and more of a divot. A bullish outcome to a bearish turn in the cyclical trend would require strength from the kind of large cap stocks that populate the Dow Jones Industrial Index.