We tend to argue with the markets far more often than is good for our health and over time we have discovered that we should never (NEVER) argue with the bond market. To the extent that PIMCO’s Bill Gross is called the ‘Bond King’ and to the extent that he is right far more often than we are… it also makes sense to be on the same side of the trend and trade that he is.

In fact… Bill Gross is bearish on the Treasury market and so are we. Our point today is not the expected direction of bond prices but instead the reason why bond prices might drift lower.

We read recently that Mr. Gross is bearish- at least in part- because the current round of Quantitative Easing is coming to an end and if the U.S. Treasury is not buying bonds then… who will? In other words if bond prices are falling even as the Treasury buys vast sums and then the buying dries up… wouldn’t it make sense for bond prices to decline at an even faster pace?

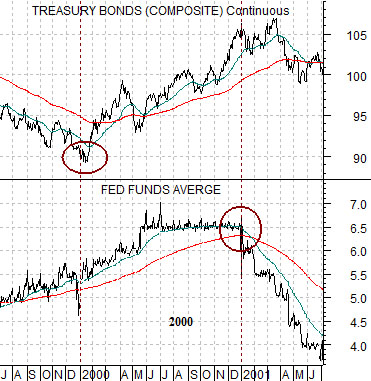

We tend to look at the markets from a different perspective so to explain our view we will start with a chart of the U.S. 30-year T-Bond futures and Fed funds rate from 1999- 2001 (top right).

Our argument is that the bond market leads the Fed. Our observation is that the bond market has tended in recent years to lead the Fed by very close to 12 months. Bond prices started to rise in January of 2000 which, of course, meant that long-term Treasury YIELDS had started to move lower. In January of 2001 the Fed cut the funds rate. The point being that long-term interest rates turned lower one year ahead of short-term yields.

The second point is that while the reaction was somewhat delayed bond prices stopped rising soon after the Fed began to lower the overnight funds rate.

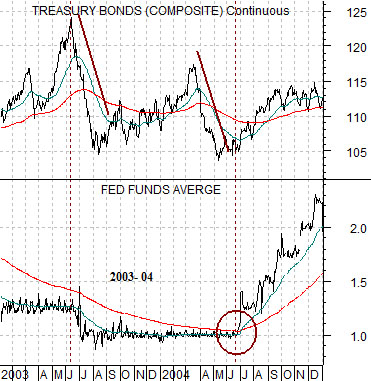

Below is the same chart comparison for the time frame between 2003 and the end of 2004. In this instance bond prices began to decline around the middle of 2003 and one year later- almost to the day- the Fed started to raise the funds rate. Furthermore… in response to the increase in the funds rate in mid-2004 long-term bond prices started to rise.

The argument is that the bond market leads and that as long as bond prices are falling (moving long-term yields higher) there is a reasonable chance of the Fed raise the funds rate one year later which, oddly enough, will lead to a fairly significant rally in long-term bond prices.

Equity/Bond Markets

So… Mr. Gross is bearish on Treasuries for a number of reasons (profligate spending, entrenched entitlement programs, the prospect of an eventual default, the looming end of quantitative easing, etc.) and the trend for the U.S. 30-year T-Bond futures (at right) has been lower.

We are bearish on Treasury prices not because quantitative easing is coming to an end but instead because… Treasury prices have been falling. While our logic may appear simplistic our perspective is somewhat more complicated.

The bond market’s message since last autumn is that previous stimulus is starting to work. We know this because bond prices are moving lower. Our expectation is that if quantitative easing ends and it has proven insufficient to kick start U.S. growth then bond prices will rise with or without Treasury support.

In Monday’s issue this week we attempted to explain that our positive view on the ‘laggard banks’ was an extension of the bond market’s bearish trend. Our sense is that a shift towards a bullish trend for the laggard sectors will begin in the cyclically weak autumn time frame so the issue was whether it began last autumn or will commence, perhaps, in the final quarter of this year.

As things stand the bond market has been trending lower in price since the autumn of 2010. If this continues then there is a reasonable chance that the Fed will raise the funds rate around the start the final quarter this year and… in response bond prices will rally for a few quarters.

To put all of this into perspective we have included once again our comparison between the trend for 10-year Treasury YIELDS and the ratio between the Morgan Stanley Consumer Index and Morgan Stanley Cyclical Index.

Over time 10-year yields have trended lower. When yields are trending lower- strangely enough- the consumer stocks will tend to outperform leading to an upward tilt for the consumer/cyclical ratio.

The twist is that during those periods of time when yields are rising- as was the case from 2003 into 2007- the cyclical stocks will out perform. Within a long-term trend a 4-year counter-trend price adjustment is a relatively significant event.

Anyway… as long as bond prices are falling then bond yields are rising. As long as yields are rising then the cyclical sectors will outperform. Our view was that current recovery would likely not end until 10-year yields had risen to the channel top which the chart shows is somewhat north of 4.0%. Putting all of this together our contention was that over time yields would continue to rise until the Fed began to raise the funds rate which would likely initiate at least a medium-term shift within the markets back towards the more defensive consumer-oriented issues.