We are going to come at the point that we wish to make today from a rather odd direction. As usual.

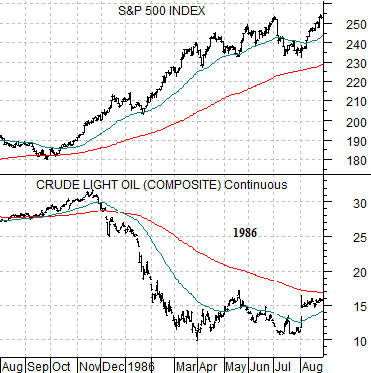

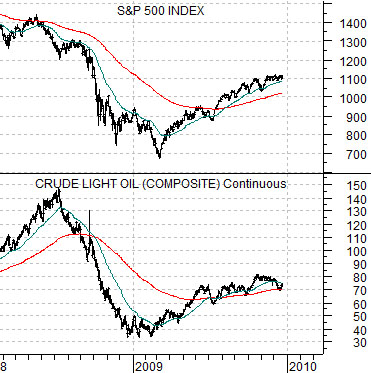

Below are two charts of the S&P 500 Index (SPX) and crude oil futures. The chart at top right is from 1985- 86 while the chart below right is from 2008 to the present day.

Crude oil prices collapsed in late 1985 tumbling from around 32 down to close to 10 by the end of the first quarter of 1986. In response the stock markets rallied.

Crude oil prices collapsed once again in 2008 and in response the stock markets buckled.

We are showing two periods of time when energy prices fell precipitously with two diametrically opposed outcomes for the equity markets. What was the difference? Oil prices moved lower into 1986 on increased supply but fell last year on a destruction of demand.

The issue is that the stock market can and will resolve higher on increased supply but will move lower if the pressures come from a reduction in demand. Fair enough.

The point that we wished to make actually has very little to do with crude oil futures prices. Instead we wanted to make a comment with respect to the U.S. dollar.

As the dollar has strengthened this month the initial reaction by the equity markets was negative. After all… dollar strength in 2008 preceded a massive collapse for asset prices. Investors have been conditioned to believe that stocks can only move higher if the dollar is falling.

Similar to crude oil the key is not whether the dollar is stronger but rather why it is stronger. If the dollar swings upwards simply because money is fleeing risk then the outcome will be bearish. If, on the other hand, the dollar is rising because money has decided that U.S. dollar-based assets will provide a better return over the coming months then the outcome can easily be bullish. Our view is that if recent dollar strength was a precursor to a return to crisis then the bond market would be surging higher in price. Given that bond prices have actually been declining we can make the case that through trading yesterday a better dollar is actually somewhat of a positive event.

Equity/Bond Markets

Second chart below is a chart of 10-year U.S. Treasury yields.

One of our ongoing arguments over the past few years has been that yields have trended higher over the first six months of the year and then lower through the final six months.

As we approach the end of the year we have to at least consider the possibility that yields will follow a similar path in 2010- rising into the end of the second quarter than easing off during the back half of the year.

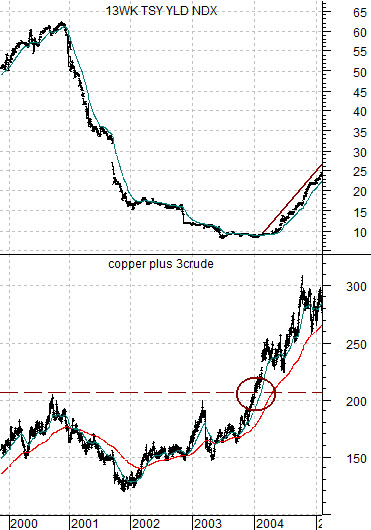

Below is a comparison between 3-month TBill yields and the sum or combination of copper and crude oil futures from the end of 1999 through into early 2005. This is- we believe- a fairly important argument.

First, cyclical is cyclical. Second, the first group to new highs generally sets the trend. Third, one or more major cyclical groups should move to new highs before short-term U.S. interest rates begin to rise. Fourth, the markets have shifted focus this month away from the Asian/commodity theme and over to ‘tech’. Fifth, the first group to new highs following the Nasdaq’s collapse in late 2000 was ‘energy and metals’. When the sum of copper and crude oil rose above the peak set in 2000 it marked the start of a rising trend for TBill yields.

This is the kind of point that requires far more time and space than we are going to give it today so we expect that we will come back to it in the near future. To grasp our point, however, you will have to glance at the chart on page 4 of IBM, Apple, and Hewlett Packard. These three stocks represent a few of the names that are threatening to move to new highs and none of them are commodity or Asian based.

Below we compare 10-year Treasury yields with the share price of Sanddisk. Notice that dollar strength in December has gone with rising yields (an indication that dollar strength is not reflective of capital fleeing risk) as money has chased into a variety of tech names. Over the past few weeks the bond market has stopped focusing on ocean freight rates and Chinese stock prices and has locked in hard on the tech theme.