The markets were roiled by two news events over the past week. China’s tightening of credit and President Obama’s rather confrontational stance with regard to the major banks. It has been our experience, however, that the markets are fully capable of doing almost anything with respect to a surprising piece of news. Which way prices trend usually reflects the direction of the trend already in progress.

Our point is that when the equity markets react to a surprising piece of news by breaking higher or lower there is a reasonable chance that they are simply moving in the direction of a preexisting trend. So instead of focusing on what happened over the past week we will back things up just a bit to show what has been evolving over the past few months.

Below is a chart comparison between crude oil futures and the share price of Canadian airline WestJet (WJA on Toronto). We rather like WJA because, unlike most airlines, it actually seems to make money most quarters.

The chart makes the rather simple argument that something changed within the markets around the end of the third quarter last year. From a rising trend for energy prices that extended from January through October the flow of money began to reverse as WJA’s share price lifted to indicate a potential peak for crude oil futures prices.

Below is a comparison between the share price of Wal Mart (WMT) and the combination of the crude oil futures times the Australian dollar (AUD) futures. We show a historical view of this relationship on page 3 today.

Without getting too mired down in the details the idea is that WMT tends to trend higher when the kind of theme that pushes oil prices and the Aussie dollar higher finally starts to wane. In other words we can make a somewhat tenuous argument that some time back around the end of last October the markets began the process of shifting away from the commodity growth theme.

Obviously this will take more time and distance to really firm up but our sense is that the weak tone exhibited by the Asian equity markets in response to China’s push towards credit tightening is a reflection of a cyclical trend that began to tire out during the fourth quarter of last year. If so then it would be historically consistent for WMT to resolve back above the recent highs around 55 to confirm the change.

Equity/Bond Markets

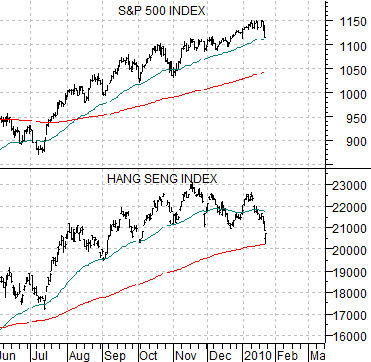

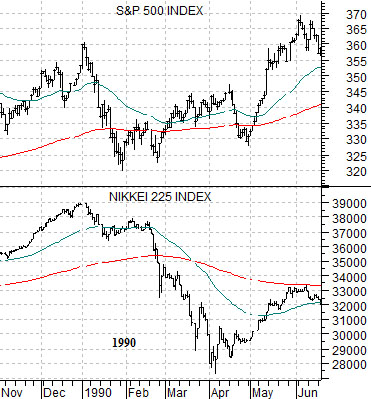

Below is a comparison between the S&P 500 Index (SPX) and Japan’s Nikkei 225 Index from way back in 1989- 90.

The simple point is that when a major Asian equity market makes a peak and turns lower… the SPX will respond negatively through the early stages.

Notice that each time the Nikkei cracked lower in 1990 the SPX followed by when the Nikkei found even brief support the U.S. markets quickly rallied back to new recovery highs.

Below we show the Hang Seng Index and SPX from the current time period.

It may be that Hang Seng is simply working through a temporary correction but the two points that we wished to make are that the SPX is obviously going to remain under some kind of pressure until the Hang Seng finds next support and… one should attempt to favor those markets that seem inclined to remain above their moving average lines once the initial pressures abate.

Below is a comparison between the sum of copper and crude oil futures and the share price of Johnson and Johnson (JNJ) from 2008.

We show the current situation on page 3. The point here is that we should probably start to get worried if the markets continue to repeat some of the tendencies that occurred just ahead of the collapse back in 2008.

The sum of copper and crude oil peaked at the end of the June in 2008 and as this sum worked back to the 200-day moving average line money shifted towards some of the more stable and lower risk names. In particular the share price of JNJ started to lift as an offset to dollar strength and commodity price weakness. Once copper and crude oil failed below the moving average line the rout began in earnest as JNJ’s share price collapsed with the broad market.