Oct. 29 (Bloomberg) — China stocks remain “a bright spot” and are set to rise by 30 percent through 2010 as the nation’s domestic demand increases, even though concerns over policy tightening will spur volatility, Goldman Sachs Group Inc. said.

We have been duckin’ and a dodgin’, bobbin’ and a weavin’ over the past while as we attempt to figure out how this is all going to end. The problem is that the two outcomes that we view as most likely are almost polar opposites. When equity and commodity prices rise on a weaker dollar… we get one kind of trend. When the dollar rises the trend makes a 180 degree reversal. Quickly.

We are trying to summon up enough conviction to take a clear stand that we can stick with for a few quarters because we absolutely loathe sitting on the fence. On the other hand we are not big fans of being steamrolled by the markets for a year or three only to proven correct during a financial markets crisis which is essentially what happened with our negative commodity markets view from 2006 into 2008.

A number of well respected U.S. economists, strategists, and portfolio managers continue to argue that asset prices are far ahead of the fundamentals. Fair enough- at least if one’s focus is on the domestic U.S. market. The problem is that this is not and has not been a trend driven by U.S. fundamentals. This is a China trend. This is a BRIC trend. To be bearish based on U.S. fundamentals may be prudent, practical, and ultimately correct but it misses the rather compelling point that the markets are global, capital is mobile, and in the absence of dollar strength asset prices look higher.

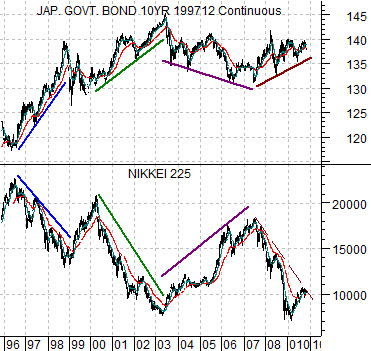

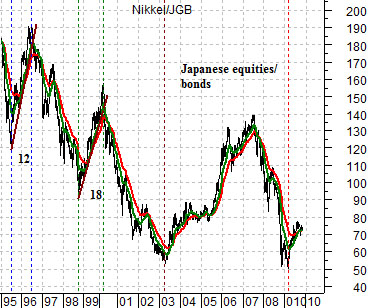

At top right- quickly- we show the Japanese bond market (JGB 10-year futures) and Japanese stock market (Nikkei 225 Index) from the end of 1995 to the present day. The argument is that over the past 15 or so years the Japanese stock market has only trending higher when bond prices were trending lower. The U.S. slipped into the relationship towards the end of 1998.

The ratio of the Nikkei (equities) to the JGBs (bonds) shows how the trend tends to ‘drive’. Equities are stronger than bonds for a period of time then bonds are stronger than equities. At present the trend favors equities and as long as this continues we would do well to favor the rising asset price trend.

Equity/Bond Markets

We started off above with a Bloomberg comment via Goldman Sachs with regard to China. We then argued that the bearish view makes sense from the perspective of the U.S. economy before shifting to charts of the Japanese bond and equity market.

Why are we leaping from topic to topic? Because we are attempting to construct an argument that is somewhat global in nature.

Below we return to the comparison between the CRB Index from 1990 into 2003 and the Nikkei 225 Index from 2000 to the current time period. We have argued over the years that there is a rather persistent ‘decade trend but that its focus shifts from decade to decade. The 1970’s were commodity price driven, the 1980’s featured consumer sector strength, while the 1990’s ultimately built into a tech and telecom boom. We have also argued that the Nikkei appears to be trending in a very similar manner to the commodity markets with a 10-year lag. The point is that this argument worked perfectly ten years ago, it marked the bottom in early 2003, it called the top in 2007 and the subsequent collapse into 2009, and now it says… onward and upward through much of next year.

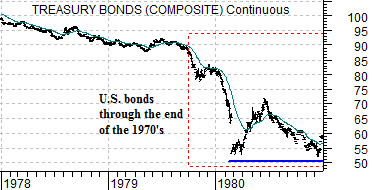

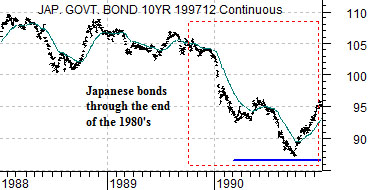

Below we show a chart of the U.S. 30-year T-Bond futures from 1978 through 1980 and a chart of the Japanese 10-year bond futures from 1988 through 1990.

The argument is that the commodity trend was driven by the U.S. economy through the 1970’s leading to a sharp collapse in long-term U.S. bonds from the start of the 4th quarter of 1979. Ten years later the trend was driven by the Japanese economy leading to a sharp collapse in Japanese bond prices starting in the 4th quarter of 1989.

It is now the 4th quarter of 2009 and we are faced with what appears to be a very strong cyclical trend. Our point is that this is about the time when we should start to see a rapid increase in interest rates… somewhere. Most likely in the country or countries that are driving the trend.