We are not sure whether everything comes down to this one relationship but it is still one of the keys that we are following closely these days. The relationship, by the way, has to do with ongoing strength in copper futures prices at the same time that bond prices keep pushing higher. In general this is what we would call a rather significant divergence…

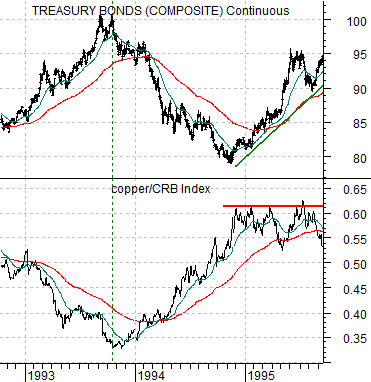

Below is a chart comparison between the U.S. 30-year T-Bond futures and the ratio between copper futures and the CRB Index from late 1992 into 1995.

The argument is that when copper prices are weak relative to the CRB Index the path of least resistance for bond prices is… up. Conversely when copper prices are strong on a relative basis bond prices will tend to trend… down.

The chart shows that weaker copper prices through into late 1993 went with a bull market for bond prices. As copper prices began to strengthen during the final quarter of 1993 bond prices worked through a top before trending lower through much of 1994. Fair enough- strong copper goes with weak bond prices and weak copper goes with strong bond prices.

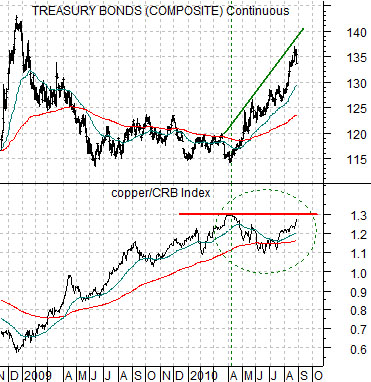

The chart below shows the same comparison starting during the final quarter of 2008.

As should be expected the rising trend for the copper/CRB Index ratio from the end of 2008 into April of 2010 went with downward pressure on long-term bond prices. Once the copper/CRB Index ratio reached a peak in April the bond market swung back to the upside which brings us to the current situation.

The bond market over the past few months has been trending in a manner similar to 1995. When the copper/CRB Index ratio reached a peak in late 1994 the bond market began to rise which was, we expect, the markets’ way of saying that copper prices had risen to some kind of peak. Two thoughts regarding this relationship come to mind. First, what happens if the copper/CRB Index ratio pushes to new highs? Second, the copper/CRB Index ratio holding near the highs through 1995 combined with rising bond prices helped create one of the strongest equity bull markets in recent history. Why are equities reacting so differently this year? As usual, of course, we have more answers than questions with regard to the markets.

Equity/Bond Markets

We are going to stick with the same three charts that we used in yesterday’s issue. We are hopefully not doing so because we are running out of inspiration and imagination but rather because we wish to create a lead-in to our 5th page argument. At least that is our intention.

There is a difference between having a premise and being right. This is especially true when a significant divergence is building. Our first page argument was that if copper prices keep rising then the bond bull market appears to be at risk. We have also argued on many occasions that copper prices trend with the Asian growth theme so the markets are, in a sense, trading copper prices higher on Asian growth while pushing long-term Treasury prices higher on U.S. economic weakness. Ultimately one of the two sides has to win out. Ultimately Asian growth trumps U.S. weakness or U.S. weakness dominates Asian growth. Our premise- for good or for bad- is that Asian growth will win the day.

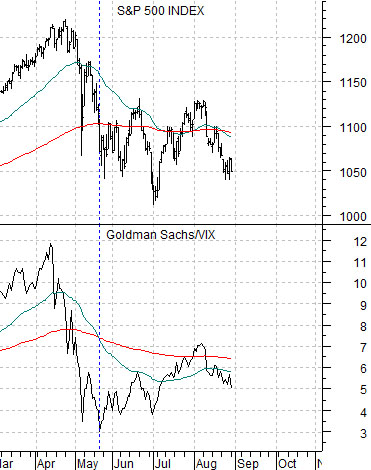

Below is a comparison between Hong Kong’s Hang Seng Index and the S&P 500 Index. The argument is that the Hang Seng Index bottomed last May and is still trending upwards. Each time the Hang Seng Index tests its channel bottom the SPX is also at a low and on the two occasions- June and August- when the Hang Seng rose to the channel top the SPX was pushing up to the 1130 range.

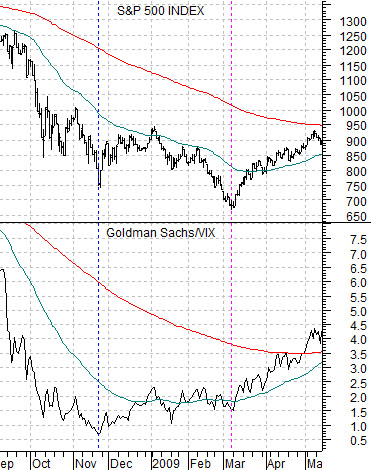

The rising trend for the Hang Seng Index goes with the Goldman Sachs/VIX ratio. Similar to late 2008 into 2009 (chart below) this ratio bottomed a few months ahead of the SPX. The premise is that if the ratio holds well above the lows into early September and then pivots higher the set up will be very similar to March of 2009 when the U.S. equity market hit bottom and began a year-long rising trend that extended into April of this year.