We start off today with a chart comparison between the sum of the U.S. 30-year T-Bond futures and U.S. Dollar Index (DXY) futures and the sum of copper futures (in cents) and crude oil futures (in dollars multiplied by three times).

The ongoing argument is that these two markets combinations serve as mirror images of each other. Strength in the bond market and dollar goes with weakness in metals and energy prices and weakness in bonds and the dollar go with commodity price strength.

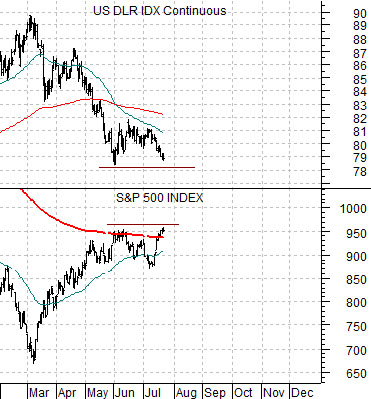

The chart of copper plus crude oil is exactly the kind of chart that one sees in far too many equities these days. Prices rose into June, backed lower into July, and are now pressing back up towards the highs. A few stocks- Intel and Apple come to mind- have managed to break to the upside but for every one that does another weakens off which serves to hold the S&P 500 Index very close to the 950 level.

In any event… the argument today is that it is not at all clear that the equity markets are going to break successfully to new highs because this would require new lows for the sum of the TBonds and dollar and new highs for the sum of copper and crude oil.

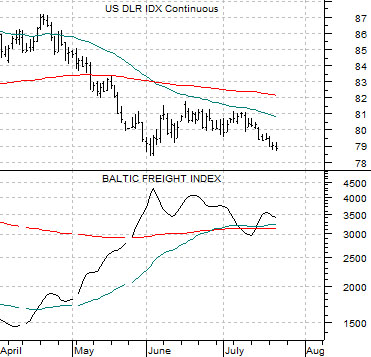

At bottom we compare the U.S. Dollar Index (DXY) futures with the Baltic Freight (Dry) Index. The BFI is an index of ocean freight rates for dry bulk cargo.

At key bottoms for the dollar the BFI makes a top. In other words the trend for ocean shipping rates trends higher and lower with the combination of copper and crude oil prices and both tend to rise when the dollar or the bond market is weaker.

The point is that while it is entirely possible that the Baltic Dry Index will resolve to new highs this quarter putting additional downward pressure on the dollar and bond market… it is obviously not a given. The BFI made a peak in early June and has been trending marginally lower for the past six weeks or so. In our view this is yet another indication that the markets are deep in the midst of either a mid-cycle consolidation or a top. Which way things swing as we move through the summer has not clearly been determined and when markets are undecided it tends to lead to choppy action, daily trend reversals, and high levels of uncertainty and stress. Such is the case at present.

Equity/Bond Markets

In yesterday’s issue we touched on the idea that if the S&P 500 Index fails to push above its 200-day e.m.a. line then chances are that it lead to dollar strength instead of dollar weakness.

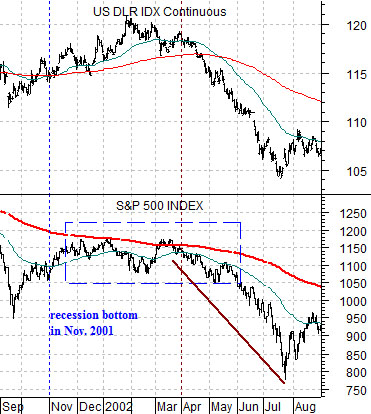

Below we show a chart of the SPX and the DXY futures from 2001- 2002. The major difference between this cycle and the one that dominated through 2000 is its relationship with the dollar.

The chart shows that the trend for the SPX was exactly the same as the trend for the dollar. Dollar strength pushed the SPX up to the moving average line and dollar weakness pulled it lower.

Compare this with the chart at bottom right which also shows the dollar and S&P 500 Index. It is not dollar strength that has pulled the markets higher but rather dollar weakness. If the SPX is going to break up through its moving average lines it will have to do so on corresponding dollar weakness.

Our point is that the key reason that the SPX has not moved cleanly above the 950 range is that the dollar is still holding its recent lows. We will argue that we can take this a step further and argue that it will take new lows for both the dollar and bond market along with new highs for the sum of crude oil and copper to push the equity markets to new highs.

A week or so ago we showed a comparison or two based on the charts of Amazon (AMZN) and Wal Mart (WMT). AMZN represents the same kind of trend that is pushing the commodity markets, commodity currencies, and Asian equity markets. Wal Mart, on the other hand, tends to rise when the markets listed above start to weaken. To get a sense of how the trend is progressing we put together a ratio chart of Amazon divided by Wal Mart and compare it below to Hong Kong’s Hang Seng Index. We will suggest that the relationship is fairly tight.