Aug. 17 (Bloomberg) — Stocks tumbled around the world, led by China, while the yen, dollar and Treasuries rose as investors speculated that a rally in riskier assets has outpaced prospects for economic growth. Energy and commodity prices also slid.

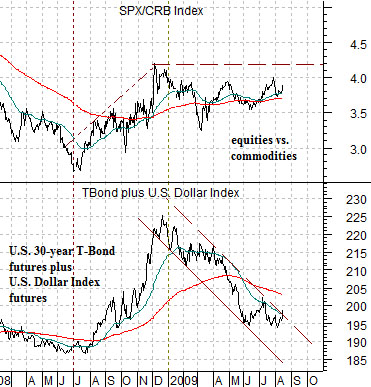

We are going to return to the chart that we used to start off yesterday’s issue. At right we compare the ratio between equities and commodities (S&P 500 Index divided by the CRB Index) to the sum of the U.S. 30-year T-Bond futures and U.S. Dollar Index (DXY).

When bond prices are falling or, from the other perspective, long-term Treasury yields are rising it usually means that cyclical growth is positive. When the dollar is falling it usually means that capital is flowing away from the U.S. in search of higher returns in foreign markets. A weak dollar AND falling bond prices tends to go with a trend that includes strong commodity prices. Fair enough.

The point we were attempting to make yesterday was that a stronger bond market along with a rising dollar puts pressure on the commodity and ‘foreign’ themes. The capital that was moving into these markets and pushing prices higher is reversing direction while falling interest rates indicates that growth is slowing. Once again… fair enough.

In a market cycle that is being driven by foreign growth and rising raw materials prices dollar and bond price strength will tend to be a negative. Such was the case in 2008. However… it is most certainly not a given that the stock market has to fall when bonds and the dollar swing higher. The chart at top right makes the simple point that the S&P 500 Index will outperform the CRB Index but does not say whether the SPX will rise or fall in absolute terms. It can rise if the CRB Index remains reasonably flat and it can fall if the CRB Index collapses but either way it will outperform.

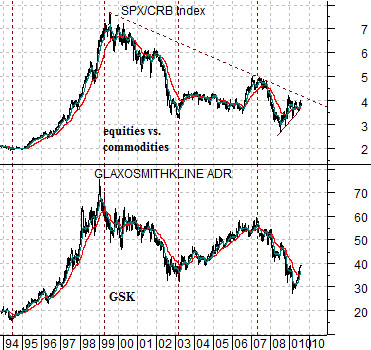

Below we compare the SPX/CRB ratio with the share price of GlaxoSmithKline (GSK). The argument is that the trend for GSK is almost identical to the equity/commodity trend. If the dollar and bond market rise AND GSK (as a surrogate for the pharma sector) rises then the negative impact of declining commodity prices can be offset or even overwhelmed. The problem last year was that even the stocks that were outperforming were declining which led to a complete stock market rout which was a substantially different outcome than 1995.

Equity/Bond Markets

Our focus today is on the pharma sector. In fact we could probably substitute most of the large cap consumer, financial, and even tech names for the pharma sector to make our point but for today we will stick with the drug and health care stocks.

On page 1 we argued that a stronger dollar and bond market leads to a rising equity/commodity ratio and a rising equity/commodity ratio goes with better relative prices for the pharma stocks.

Below we compare the ratio between the pharma etf (PPH) and the S&P 500 Index (SPX) to the cross rate between the Japanese yen and Canadian dollar (JPY/CAD).

The point is that a rising JPY/CAD will go with a rising PPH/SPX. The stronger then yen and the weaker the commodity currencies the better the pharma names will do relative to the broad market.

Below we compare the ratio between Johnson and Johnson (JNJ) and FreePort McMoRan (FCX) with 10-year Treasury yields. The argument is that when long-term yields are rising one is better off in something like a copper producer than a health care-oriented defensive. The problem is that long-term yields have not been rising since early June so over the past two months the markets have been working through either a consolidation or a trend change. Either yields are set to move to new highs or… and this has been our view…. the markets are transitioning back to the large cap U.S. consumer and health care names.

Below we compare Abbott Labs (ABT) with the sum of copper and crude oil futures. The ongoing argument has been that ABT will remain beneath its 50-day e.m.a. line as long as copper and crude oil are pushing higher. Briefly in both June and July ABT swung above this line as pressures built and then dissipated on the commodity sector. A nice move above 45 by ABT would help to support our thesis that the back half of 2009 will involve falling interest rates and weaker commodity prices.